Weekly Market Highlights:

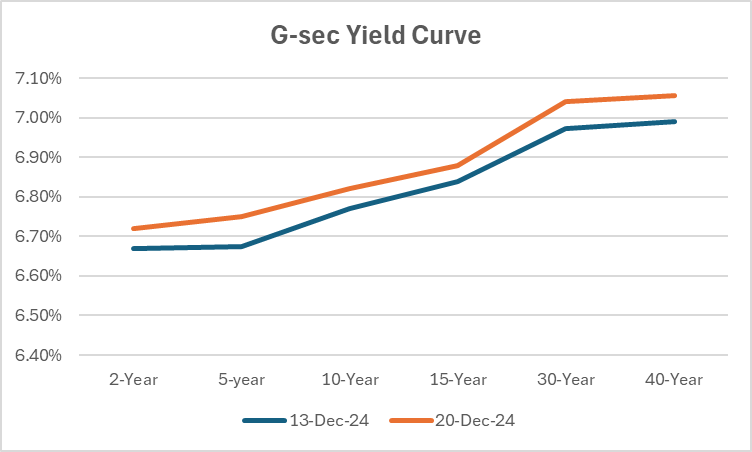

- The 10-year 2034 G-sec yield edged up 5 bps to 6.79% for the week as FPI/FDIs see outflows from Indian markets amid rising dollar.

- 3M and 6M T-bill auction data yields were at 6.23% and 6.55% respectively compared to 6.45% and 6.61% last week.

- The INR Bonds High Yield Retail Index stood at 9.77%, up 4 bps fortnightly.

- Former RBI Gov Das urged to restore the balance between inflation and growth, focusing on reducing inflation to meet the target and the members see easing of food inflation according to the December 4-6 MPC meeting minutes released by the RBI.

- India's banking system faced a deep liquidity deficit, its highest in 6 months, driven by advance tax payments, RBI dollar sales, and festive cash withdrawals, pushing up borrowing costs despite recent liquidity-boosting measures.

- The rupee recovered 10 paise to 85.03 against the dollar on Friday, aided by a softer Dollar Index and potential RBI intervention. However, sustained dollar demand and limited Fed rate cut prospects for 2025 may keep the rupee under pressure.

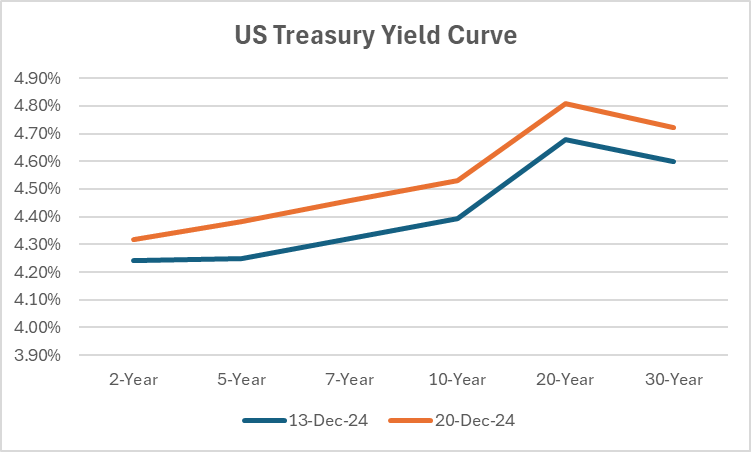

- The Fed cut rates by 25bps to 4.25%-4.5%, its 3rd consecutive reduction, but signaled caution with only 2 rate cuts projected for 2025. Inflation is expected to end 2024 at 2.5%, and economic growth for 2025 was slightly revised to 2.1%. Policymakers also hinted at a cautious policy approach.

- US equities fell 3.5%, and 10Y UST yield rose 13 bps to 4.53% post-announcement of FED’s rate cut path for 2025.

- The rupee hit a new low of 85.05 amid FDI outflows, while Indian equities dropped 1%, and 10Y G-Sec yield opened at 6.78% as global sentiment soured. US Job data and India PMI data to drive markets in the coming weeks.

- The Bank of England kept rates unchanged at 4.75% amid uncertainty over cost impacts on prices, jobs, and wages. However, three of nine MPC members favored a 0.25% cut to address the slowing economy.

- US junk bond yield went up 43 bps this week to 7.30%. US junk bond-10Y UST spread is at 277 bps amid FED rate cut and rising dollar.

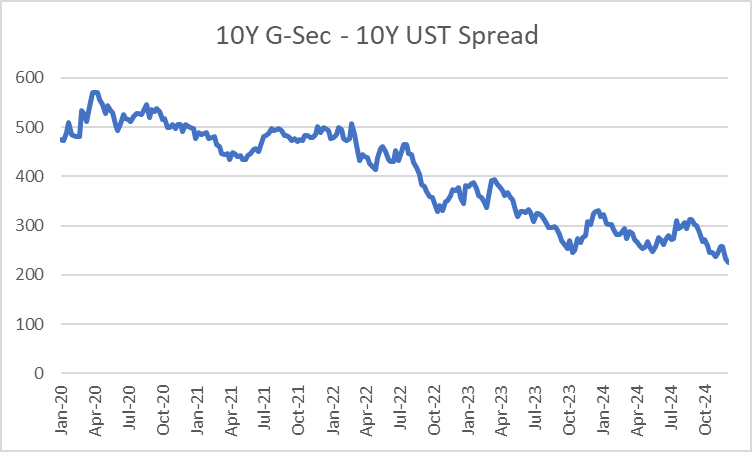

- 10Y G-Sec - 10Y UST spreads at a 20 year low of 224 bps amid FDI/FPI outflows from Indian markets and RBIs dollar sales.

Market Data | |||

Particulars | 20/12/2024 | 13/12/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.79% | 6.74% | 5 bps |

Banking Liquidity (in Rs Billion) | -162.4 | 64.31 | -352.53% |

5 Yr OIS (%) | 6.23% | 6.04% | 19 bps |

1 Yr OIS (%) | 6.55% | 6.41% | 14 bps |

INRBonds Retail High Yield Index | 9.77% | 9.77% | 0 bps |

Nifty | 23,588 | 24,768 | -4.77% |

10 Yr SDL | 7.12% | 7.10% | 2 bps |

91 Day T-Bill (%) | 6.47% | 6.45% | 2 bps |

182 Day T-Bill (%) | 6.64% | 6.61% | 3 bps |

10 Yr US Treasury Yield (%) | 4.53% | 4.40% | 12.9 bps |

US Junk Bond Yield (%) | 7.30% | 6.87% | 43 bps |

Brent Crude Oil (In USD per Barrel) | 72.99 | 74.43 | -1.93% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

11.25% Indel Money Limited | 6/4/2026 | 12.00% | |

9.75% Hinduja Leyland Finance Limited | 21/4/2028 | 10.17% | |

10.45% Muthoot Fincorp Limited | 24/12/1932 | 11.26% | |

11.10% Esaf Small Finance Bank | 20/4/1931 | 11.20% | |

10.50% Navi Finserv Limited | 18/7/2026 | 12.20% | |

Currency Market Data | |||

Particulars | 20/12/2024 | 13/12/2024 | Change |

USD/INR | 84.947 | 84.782 | 0.19% |

DXY | 107.62 | 107 | 0.58% |

USD/ Brazil Real | 5.91 | 5.89 | 0.34% |

EUR/ USD | 1.0429 | 1.0502 | -0.70% |

USD/CNY | 7.2961 | 7.2756 | 0.28% |

USD/JPY | 156.41 | 153.64 | 1.80% |

USD/ Russian Ruble | 102.9955 | 104.4955 | -1.44% |