Weekly Market Highlights:

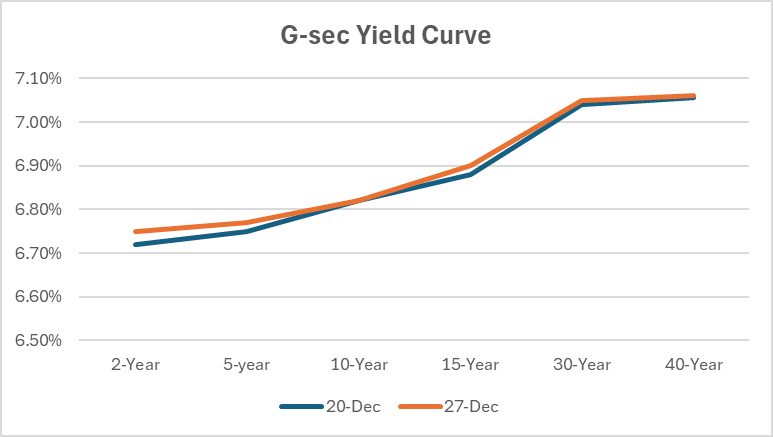

- The 10-year 2034 G-sec yield dropped 1 bps to 6.78% for the week.

- 3M and 6M T-bill auction data yields were at 6.55% and 6.70% respectively compared to 6.47% and 6.64% last week.

- The INR Bonds High Yield Retail Index stood at 9.77%, up 4 bps fortnightly.

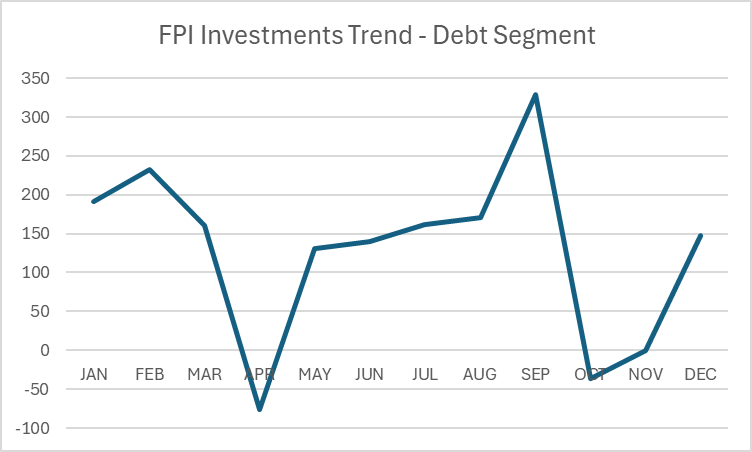

- FPIs have turned net buyers in December with inflows of Rs. 150 bn this month in debt markets.

- Rupee hit a new low of 85.80 against the dollar as rupee remains under selling pressure due to sustained strong USD demand from importers, foreign investors, and oil-related companies.

- India’s CAD narrowed to 1.2% of GDP in Q2FY25 from 1.3% in Q2FY24, despite a higher trade deficit, supported by buoyant services exports and strong remittances.

- India’s capital account surplus expanded, led by FPI inflows, while FDI outflows were recorded higher. As a result, BoP surplus was recorded higher at USD 18.6 bn in Q2FY25 compared to USD 2.5 billion in Q2FY24.

- Indian foreign reserves fell to USD 644 bn amid a 7-month high liquidity deficit and RBI’s dollar sales to stabilize the Rupee.

- The US trade deficit widened more than expected in November with imports rising due to higher purchase of capital and consumer goods.

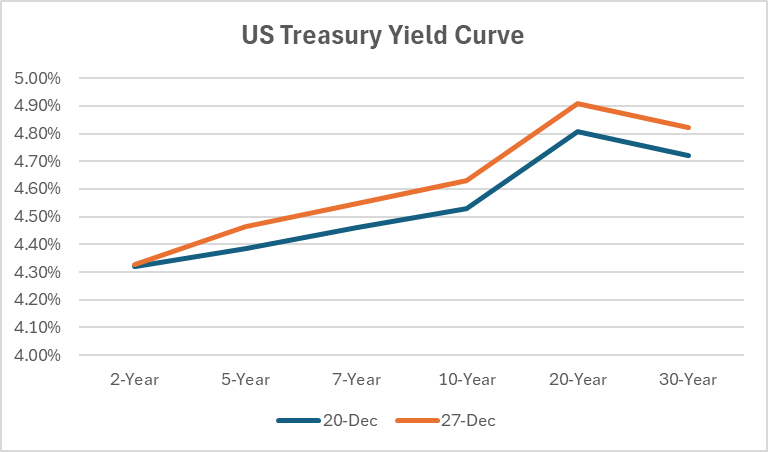

- The 10Y UST yield rose 10 bps as investors weighed whether the Fed's recent hawkish stance signals higher interest rates next year or if upcoming employment and inflation data in mid-January could alter its plans.

Market Data | |||

Particulars | 27/12/2024 | 20/12/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.78% | 6.79% | -1 bps |

Banking Liquidity (in Rs Billion) | -189.23 | -162.4 | -16.52% |

5 Yr OIS (%) | 6.23% | 6.23% | 0 bps |

1 Yr OIS (%) | 6.53% | 6.55% | -2 bps |

INRBonds Retail High Yield Index | 9.77% | 9.77% | 0 bps |

Nifty | 23,813 | 23,588 | 0.96% |

10 Yr SDL | 7.15% | 7.12% | 3 bps |

91 Day T-Bill (%) | 6.55% | 6.47% | 8 bps |

182 Day T-Bill (%) | 6.70% | 6.64% | 6.01 bps |

10 Yr US Treasury Yield (%) | 4.63% | 4.53% | 10 bps |

US Junk Bond Yield (%) | 7.26% | 7.30% | -4 bps |

Brent Crude Oil (In USD per Barrel) | 73.81 | 72.99 | 1.12% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

7.70% Rural Electrification Corporation Limited | 31/8/2026 | 7.60% | |

10.15% Ugro Capital Limited | 24/4/2026 | 11.00% | |

10.5% Ambium Finserv Private Limited | 21/12/2025 | 11.00% | |

9.40% Mas Financial Services Limited | 23/6/2026 | 10.05% | |

7.08% Indian Railway Finance Corporation | 28/2/1930 | 7.30% | |

Currency Market Data | |||

Particulars | 20/12/2024 | 20/12/2024 | Change |

USD/INR | 85.388 | 84.947 | 0.52% |

DXY | 108.01 | 107.62 | 0.36% |

USD/ Brazil Real | 6.03 | 5.91 | 2.03% |

EUR/ USD | 1.0427 | 1.0429 | -0.02% |

USD/CNY | 7.298 | 7.2961 | 0.03% |

USD/JPY | 157.82 | 156.41 | 0.90% |

USD/ Russian Ruble | 105.7455 | 102.9955 | 2.67% |