Weekly Market Highlights:

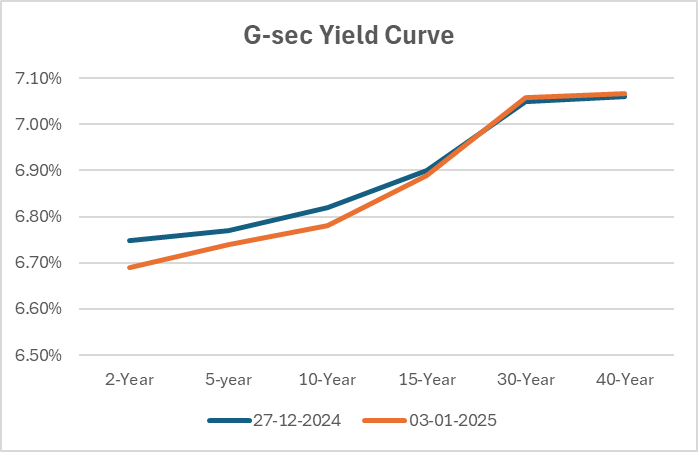

- The 10-year 2034 G-sec yield remained stable close to 6.79% for the week.

- 3M and 6M T-bill auction data yields were at 6.56% and 6.72% respectively compared to 6.55% and 6.70% last week.

- The INR Bonds High Yield Retail Index stood at 9.79%, up 2 bps fortnightly.

- India’s manufacturing activity hit a 12-month low in December, with the PMI dropping to 56.4 from 56.5 in November, marking the weakest growth of 2024, according to S&P Global. Despite softer increases in output, new orders, and stocks, the PMI remained above its long-term average of 54.1, signaling growth amid easing cost pressures and strong job creation.

- Ahead of the Union Budget 2025-26 on 1st February, the CII urged measures to boost consumption, such as cutting fuel excise duty, raising the daily minimum wage, and increasing PM-KISAN payouts. Banks also called for tax incentives on fixed deposits to encourage savings.

- Oil climbed 3.43% this week due to expectations of more stimulus in China and increased heating oil demand in Europe and the US.

- The dollar index was close to 109, its highest level in 2 years as markets await key labor data that will impact FOMC’s outlook. UST to be driven by FOMC meeting minutes and job data this week.

- The 10Y UST closed at 4.61% as markets awaited Trump assuming office. Global markets brace for Trump sanctions with significant sanctions expected on oil exporting nations like Iran, Russia and Venezuela.

Market Data | |||

Particulars | 3/1/2024 | 27/12/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.79% | 6.78% | 1 bps |

Banking Liquidity (in Rs Billion) | -38.6 | -189.23 | 79.60% |

5 Yr OIS (%) | 6.22% | 6.23% | -2 bps |

1 Yr OIS (%) | 6.51% | 6.53% | -2 bps |

INRBonds Retail High Yield Index | 9.79% | 9.77% | 2 bps |

Nifty | 24,001 | 23,813 | 0.79% |

10 Yr SDL | 7.15% | 7.15% | 0 bps |

91 Day T-Bill (%) | 6.56% | 6.55% | 1 bps |

182 Day T-Bill (%) | 6.72% | 6.70% | 2 bps |

10 Yr US Treasury Yield (%) | 4.61% | 4.63% | -1.9 bps |

US Junk Bond Yield (%) | 7.25% | 7.26% | -1 bps |

Brent Crude Oil (In USD per Barrel) | 76.34 | 73.81 | 3.43% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

7.70% Rural Electrification Corporation Limited | 31/8/2026 | 7.60% | |

10.15% Ugro Capital Limited | 24/4/2026 | 11.00% | |

10.5% Ambium Finserv Private Limited | 21/12/2025 | 11.00% | |

9.40% Mas Financial Services Limited | 23/6/2026 | 10.05% | |

7.08% Indian Railway Finance Corporation | 28/2/1930 | 7.30% | |

Currency Market Data | |||

Particulars | 3/1/2024 | 27/12/2024 | Change |

USD/INR | 85.788 | 85.388 | 0.47% |

DXY | 108.91 | 108.01 | 0.83% |

USD/ Brazil Real | 6.02 | 6.03 | -0.17% |

EUR/ USD | 1.0314 | 1.0427 | -1.08% |

USD/CNY | 7.3181 | 7.298 | 0.28% |

USD/JPY | 157.18 | 157.82 | -0.41% |

USD/ Russian Ruble | 109.704 | 105.7455 | 3.74% |