Weekly Market Highlights:

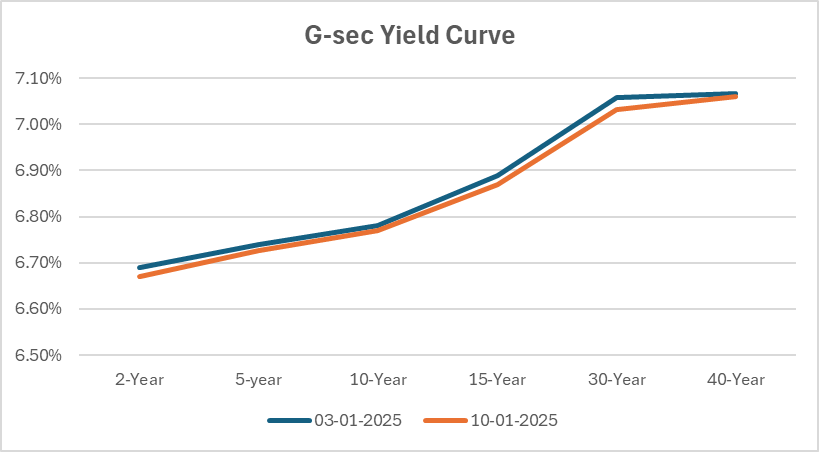

- The 10-year 2034 G-sec yield remained stable close to 6.77% for the week. G-secs to be driven by CPI data this week.

- 3M and 6M T-bill auction data yields were at 6.59% and 6.70% respectively compared to 6.56% and 6.72% last week.

- The INR Bonds High Yield Retail Index stood at 9.79%, up 2 bps fortnightly.

- Foreign investors purchased a net Rs 70 bn of government securities under the FAR in December 2024 but sold a net Rs 34 bn in January 2025 so far, according to Clearing Corporation of India data. After being net sellers in November, driven by lower-than-expected Q2 growth, the first quarter of the year might be challenging for Indian bond and equity markets due to narrowing spreads.

- The Indian BFSI sector in Q3FY25 showcased mixed business growth. However, few banks reported strong double-digit deposit and credit growth, maintaining low-cost CASA deposits proved difficult, leading to a shift toward higher-cost term deposits. Profitability faced pressure from increased provisions and competition, and asset quality issues emerged, particularly in the microfinance sector, with rising GNPA and NNPA ratios.

- FOMC Minutes released Wednesday revealed that Federal Reserve officials, during their December policy-meeting, voiced concerns about inflation and the potential impact of President-elect Donald Trump’s policies. They indicated that uncertainty surrounding these factors could lead them to proceed more cautiously with interest rate cuts.

- The latest US nonfarm payrolls report shows the economy added 256,000 jobs in December 2024, exceeding the consensus forecast of 155,000, while the unemployment rate fell to 4.1%, contrary to expectations of holding steady at 4.2%. Job growth increased from 212,000 in November, bringing the total for 2024 to 2.2 million jobs, lower than the 3 million added in 2023 and record 6.4 million in 2021 as the economy rebounded from pandemic-induced layoffs.

- The yield on the US 10-year Treasury note climbed to nearly 4.79% on Friday, marking a 14-month high, following a stronger-than-expected payrolls report that strengthened expectations of the Federal Reserve slowing its pace of rate cuts. UST to be driven by much awaited CPI data this week.

Market Data | |||

Particulars | 10/1/2024 | 3/1/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.77% | 6.79% | -2 bps |

Banking Liquidity (in Rs Billion) | -200.1 | -38.6 | -418.39% |

5 Yr OIS (%) | 6.23% | 6.22% | 1 bps |

1 Yr OIS (%) | 6.52% | 6.51% | 0 bps |

INRBonds Retail High Yield Index | 9.79% | 9.79% | 0 bps |

Nifty | 23,432 | 24,001 | -2.37% |

10 Yr SDL | 7.15% | 7.15% | 0 bps |

91 Day T-Bill (%) | 6.59% | 6.56% | 3 bps |

182 Day T-Bill (%) | 6.70% | 6.72% | -2.05 bps |

10 Yr US Treasury Yield (%) | 4.76% | 4.61% | 15 bps |

US Junk Bond Yield (%) | 7.25% | 7.25% | 0 bps |

Brent Crude Oil (In USD per Barrel) | 79.68 | 76.34 | 4.38% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.85% Akara Capital Advisors Private Limited | 17/4/2026 | 14.00% | |

10.75% MAS Financial Services Limited | 20/5/2027 | 12.00% | |

10.55% Chaitanya India Fin Credit Private Limited | 30/9/2026 | 10.00% | |

11.80% Namdev Finvest Private Limited | 5/7/2027 | 12.55% | |

9.50% Incred Financial Services Limited | 11/12/2026 | 10.40% | |

Currency Market Data | |||

Particulars | 10/1/2024 | 3/1/2024 | Change |

USD/INR | 86.165 | 85.788 | 0.44% |

DXY | 109.65 | 108.91 | 0.68% |

USD/ Brazil Real | 5.95 | 6.02 | -1.16% |

EUR/ USD | 1.0244 | 1.0314 | -0.68% |

USD/CNY | 7.3326 | 7.3181 | 0.20% |

USD/JPY | 157.69 | 157.18 | 0.32% |

USD/ Russian Ruble | 101.7455 | 109.704 | -7.25% |