Weekly Market Highlights:

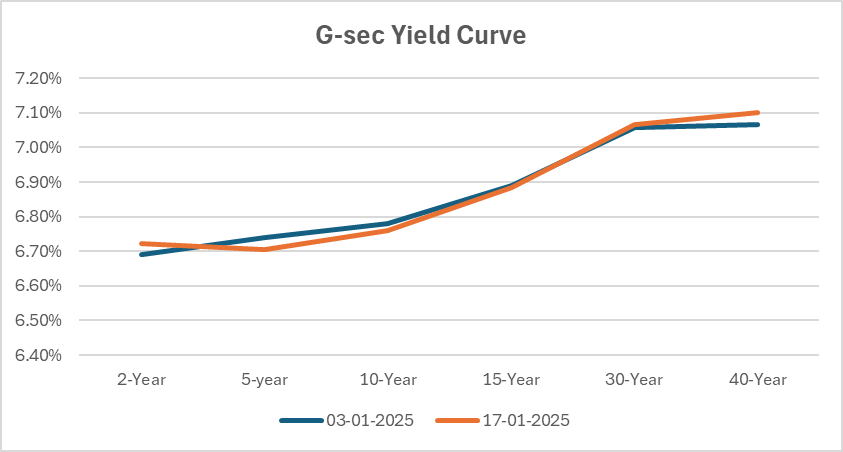

- The 10-year 2034 G-sec yield remained stable close to 6.76% for the week. G-secs to be driven by budget and RBI MPC meeting expectations this week.

- 3M and 6M T-bill auction data yields were at 6.60% and 6.72% respectively compared to 6.59% and 6.70% last week.

- The INR Bonds High Yield Retail Index stood at 9.78%, down 1 bps fortnightly.

- Finance Minister Nirmala Sitharaman will present her eighth budget on February 1, focusing on tax simplification, increased capital spending, and measures to boost consumption amid slowing domestic growth and global uncertainties. Key expectations include income tax relief, GST rationalization, and industry-specific incentives to revive the economy.

- RBI MPC is set to meet on 5th Feb, its last meeting this Fiscal Year. A 4-month low CPI of 5.2% in December could support a rate cut in this meeting, but a weakening rupee, which may raise import costs and drive up inflation, could delay the decision.

- The US Federal Reserve set to meet on 29th January, fixed income markets expect 2-3 rate cuts in 2025. The FOMC's December 2024 projections indicate two rate cuts as the most likely scenario.

- Treasury yields fell sharply midweek, with the 10-year dropping 13 basis points and the 2-year 10 basis points, after the benchmark hit a 14-month high earlier. By Friday, yields steadied as investors evaluated the US inflation outlook.

- WTI crude oil futures traded near USD 78 per barrel as traders assessed the potential impact of President-elect Donald Trump’s return to the White House. Focus remains on US sanctions on Russia’s oil sector and possible tariffs or sanctions on Iran and Venezuela. However, easing tensions in the Middle East, marked by a ceasefire between Hamas and Israel, could cap further price gains.

Market Data | |||

Particulars | 17/1/2024 | 10/1/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.76% | 6.77% | -1 bps |

Banking Liquidity (in Rs Billion) | -2359.4 | -2001 | -17.91% |

5 Yr OIS (%) | 6.25% | 6.23% | 2 bps |

1 Yr OIS (%) | 6.47% | 6.52% | -5 bps |

INRBonds Retail High Yield Index | 9.78% | 9.79% | -1 bps |

Nifty | 23,203 | 23,432 | -0.98% |

10 Yr SDL | 7.22% | 7.15% | 7 bps |

91 Day T-Bill (%) | 6.60% | 6.59% | 1 bps |

182 Day T-Bill (%) | 6.72% | 6.70% | 1.91 bps |

10 Yr US Treasury Yield (%) | 4.63% | 4.76% | -13 bps |

US Junk Bond Yield (%) | 7.10% | 7.25% | -15 bps |

Brent Crude Oil (In USD per Barrel) | 80.78 | 79.68 | 1.38% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.25% Motilal Oswal Financial Services Limited | 3/9/2032 | 9.30% | |

10.90% Earlysalary Services Private Limited | 6/5/2026 | 12.86% | |

9.55% Indostar Home Finance Limited | 13/4/2028 | 10.38% | |

10.40% Clix Capital Services Private Limited | 12/6/2025 | 10.38% | |

9.50% Hinduja Leyland Finance Limited | 29/11/2029 | 10.00% | |

Currency Market Data | |||

Particulars | 17/1/2024 | 10/1/2024 | Change |

USD/INR | 86.571 | 86.165 | 0.47% |

DXY | 109.35 | 109.65 | -0.27% |

USD/ Brazil Real | 5.86 | 5.95 | -1.51% |

EUR/ USD | 1.0271 | 1.0244 | 0.26% |

USD/CNY | 7.3249 | 7.3326 | -0.11% |

USD/JPY | 156.3 | 157.69 | -0.88% |

USD/ Russian Ruble | 102.4955 | 101.7455 | 0.74% |