Weekly Market Highlights:

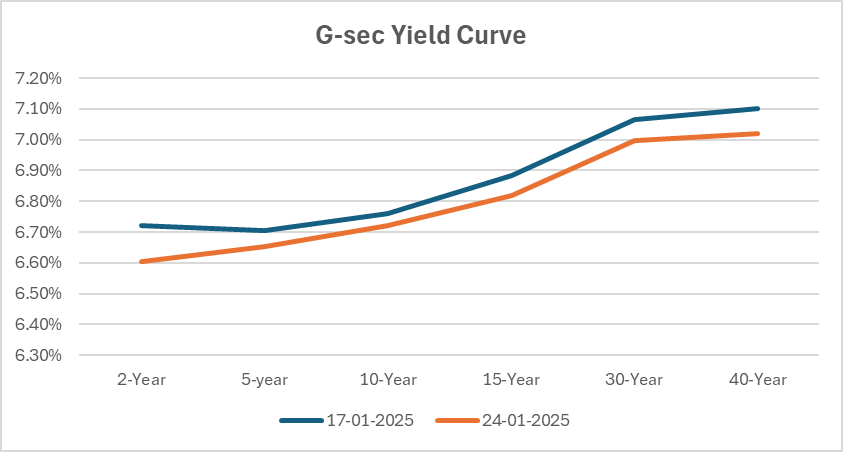

- The 10-year 2034 G-sec yield closed 4 bps lower this week to 6.72% for the week.

- 3M and 6M T-bill auction data yields were at 6.61% and 6.71% respectively compared to 6.60% and 6.72% last week.

- The INR Bonds High Yield Retail Index stood at 9.78%, down 1 bps fortnightly.

- The Rupee closed at 86.20 per dollar posting its biggest weekly gain since August 2023. RBI forex reserves fell to USD 624 B, down from record highs of 700 B.

- India's private sector growth slowed in January to a 13-month low, as strong manufacturing expansion (PMI at 58.0, a 6-month high) was outweighed by weaker services growth (PMI at 56.8). The HSBC composite output index fell to 56.8 from 59.3 in December, missing expectations of 59.6 but still signaling expansion.

- Gold surged above USD 2,770 per ounce on Friday, its highest since October and near the record USD 2,790, driven by a weaker dollar and President Trump's call for lower interest rates during a World Economic Forum speech. Safe-haven demand also rose amid uncertainty over Trump’s proposed tariffs and immigration policies.

- BoJ has raised its interest rates to its highest level since 2009 as expected on Friday, while the Fed is anticipated to hold rates next week, and the ECB is expected to cut them.

- The U.S. dollar dropped this week, heading for its largest weekly loss in over a year, after President Trump hinted at easing tariffs on China, heightening trade policy uncertainty and unsettling equity markets. UST to be driven by FOMC outlook and markets brace for Trump’s next move.

Market Data | |||

Particulars | 24/1/2024 | 17/1/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.72% | 6.76% | -4 bps |

Banking Liquidity (in Rs Billion) | -3156.2 | -2359.4 | -33.77% |

5 Yr OIS (%) | 6.13% | 6.25% | -12 bps |

1 Yr OIS (%) | 6.36% | 6.47% | -11 bps |

INRBonds Retail High Yield Index | 9.78% | 9.78% | 0 bps |

Nifty | 23,092 | 23,203 | -0.48% |

10 Yr SDL | 7.12% | 7.22% | -10 bps |

91 Day T-Bill (%) | 6.61% | 6.60% | 1 bps |

182 Day T-Bill (%) | 6.71% | 6.72% | -1.18 bps |

10 Yr US Treasury Yield (%) | 4.62% | 4.63% | -1.01 bps |

US Junk Bond Yield (%) | 7.02% | 7.10% | -8 bps |

Brent Crude Oil (In USD per Barrel) | 78.46 | 80.78 | -2.87% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

10.76% Lendingkart Finance Limited | 10/5/2026 | 13.21% | |

9.10% Shriram Finance Limited | 20/6/1934 | 9.05% | |

9.90% IKF Finance Limited | 30/12/2027 | 9.00% | |

6.75% Piramal Capital & Housing Finance Limited | 26/9/1931 | 10.60% | |

10.00% Nido Home Finance Limited | 19/7/2026 | 11.83% | |

Currency Market Data | |||

Particulars | 24/1/2024 | 17/1/2024 | Change |

USD/INR | 86.2 | 86.571 | -0.43% |

DXY | 107.44 | 109.35 | -1.75% |

USD/ Brazil Real | 5.77 | 5.86 | -1.54% |

EUR/ USD | 1.0493 | 1.0271 | 2.16% |

USD/CNY | 7.244 | 7.3249 | -1.10% |

USD/JPY | 155.98 | 156.3 | -0.20% |

USD/ Russian Ruble | 97.7995 | 102.4955 | -4.58% |