Weekly Market Highlights:

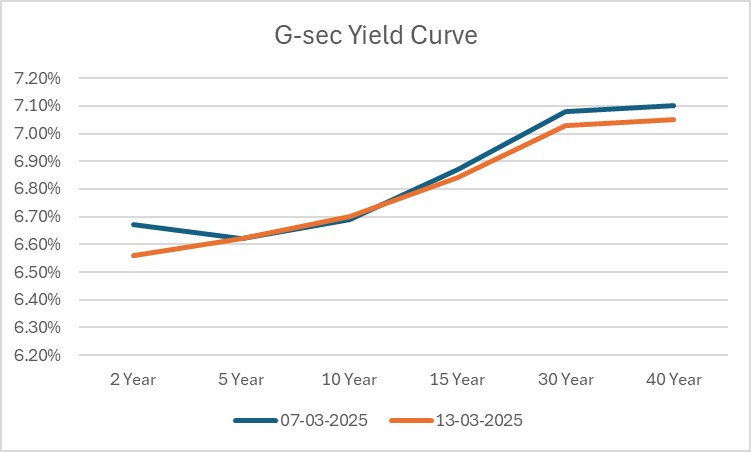

- The 10-year 2034 G-sec yield closed 1 bps up this week to 6.69% for the week.

- The 3M and 6M T-bill auction data yields remained stable at 6.49% and 6.61% respectively.

- The INR Bonds High Yield Retail Index stood at 10.23%, up 16 bps biweekly.

- India’s retail inflation eased to a seven-month low of 3.61% in February 2025, driven by lower food prices, down from 4.31% in January. Food inflation dropped sharply to 3.75%, the lowest since May 2023. The decline was mainly due to lower prices of vegetables, eggs, meat, fish, pulses, and dairy products, per NSO data.

- While overall inflation eased, core inflation rose to 4.08% after 14 months, driven by higher gold prices. Stable global edible oil prices and a normal monsoon outlook suggest a positive food inflation trend ahead.

- India’s industrial production (IIP) grew 5% in January 2025, an eight-month high, led by strong manufacturing performance. December 2024’s IIP growth was revised up to 3.5% from 3.2%.

- With inflation well within RBI’s 4% target, the central bank, which cut the repo rate by 25 bps last month, may opt for another cut in April’s policy meeting (April 7–9).

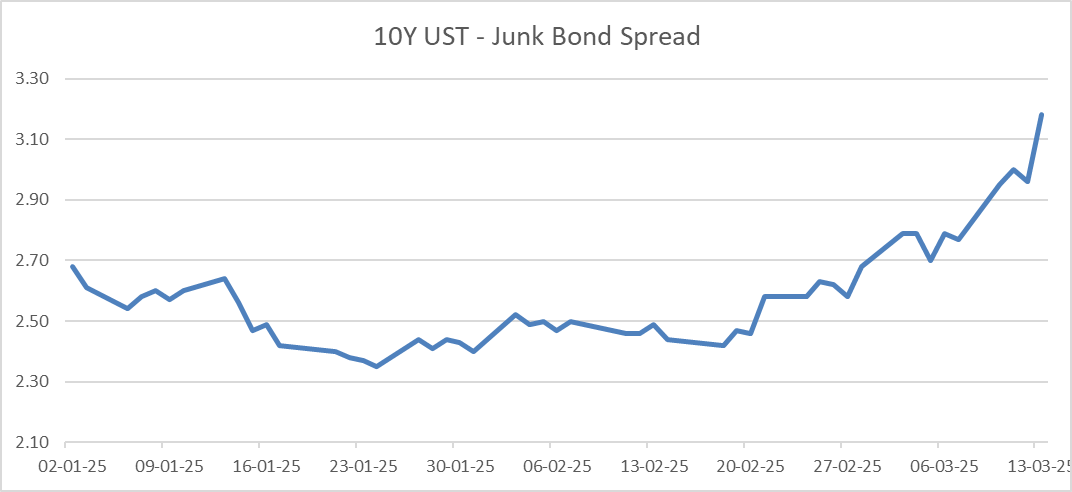

- US inflation cooled in February, with core CPI at 3.1%, slightly below expectations of 3.2%. However, economists warn that escalating tariffs could drive prices higher on essentials like food and clothing. President Trump softened his stance on new tariffs against Canada after initially threatening them, downplaying the risk of a tariff-driven recession. Markets remain volatile as fears of a trade war’s impact on inflation and growth weigh on global sentiment.

- Wall Street had a volatile week as US stocks plunged on Trump’s tariff threats but rebounded Friday, led by tech stocks. Equities followed European markets higher, though investor anxiety persisted, driving gold to a record high. The S&P 500 fell over 10% from its February peak after Trump threatened a 200% tariff on European wine and spirits, escalating trade tensions. Europe had retaliated against US steel and aluminum tariffs, fueling market uncertainty. Despite the rebound, fears of a prolonged trade war and its economic impact continue to pressure investor sentiment.

Market Data | |||

Particulars | 14/3/2025 | 7/3/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.69% | 6.68% | 1 bps |

Banking Liquidity (in Rs Billion) | -138152.9 | -56909 | -142.76% |

5 Yr OIS (%) | 5.97% | 5.96% | 1 bps |

1 Yr OIS (%) | 6.13% | 6.19% | -6 bps |

INRBonds Retail High Yield Index | 10.23% | 10.07% | 16 bps |

Nifty | 22,397 | 22,481 | -0.37% |

10 Yr SDL | 7.18% | 7.22% | -4 bps |

91 Day T-Bill (%) | 6.49% | 6.49% | 0 bps |

182 Day T-Bill (%) | 6.61% | 6.61% | 0.31 bps |

10 Yr US Treasury Yield (%) | 4.32% | 4.32% | 0.21 bps |

US Junk Bond Yield (%) | 7.45% | 7.09% | 36 bps |

Brent Crude Oil (In USD per Barrel) | 70.07 | 70.36 | -0.41% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.70% U.P Power Corporation Limited | 30/3/2029 | 9.05% | |

9.25% Sammaan Capital Limited | 25/9/2026 | 12.35% | |

9.30% SMFG India Credit Company Limited | 8/6/2028 | 9.03% | |

8.42% IIFL Finance Limited | 14/10/2026 | 10.40% | |

9.90% Muthoot Capital Services Limited | 29/10/2026 | 10.85% | |

Currency Market Data | |||

Particulars | 14/3/2025 | 7/3/2025 | Change |

USD/INR | 86.941 | 86.88 | 0.07% |

DXY | 103.72 | 104.028 | -0.30% |

USD/ Brazil Real | 5.60 | 5.7872 | -3.23% |

EUR/ USD | 1.0879 | 1.0859 | 0.18% |

USD/CNY | 7.2377 | 7.234 | 0.05% |

USD/JPY | 148.62 | 147.13 | 1.01% |

USD/ Russian Ruble | 85.4955 | 89.35 | -4.31% |