Weekly Market Highlights:

- The 10-year 2034 G-sec yield closed 4 bps down to 6.59% for the week.

- The 3M and 6M T-bill auction data yields softened to 6.519% and 6.518% respectively.

- The INR Bonds High Yield Retail Index stood at 10.07%, down 16 bps fortnightly.

- RBI will aim to alleviate credit stress by injecting liquidity into the market. To manage this liquidity, the central bank may either cut rates by 25bps points or adopt a dovish stance. Currently, market expectations are leaning towards a 25 bps rate cut. The monetary policy committee is set to meet 6 times in FY26, with its first meeting scheduled for April 7–9. These decisions will be closely watched for their impact on inflation, growth, and overall economic stability.

- India's CAD increased slightly to USD 11.5 billion, or 1.1% of GDP, in Q3FY25, compared to USD 10.4 billion, or 1.1% of GDP, in the same period a year ago, driven by a rise in service exports. However, on a sequential basis, the CAD eased from USD 16.7 billion, or 1.8% of GDP, recorded in Q2FY25, according to the latest data released by the RBI.

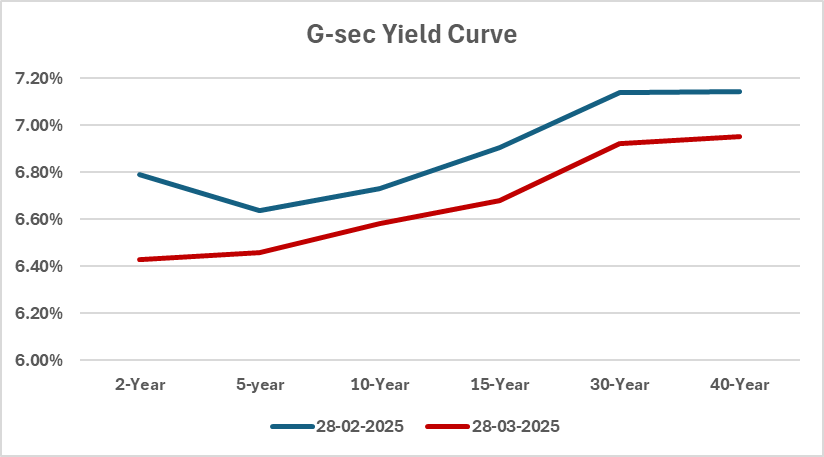

- India plans to raise Rs 8 trillion (USD 93.63 billion) through bond sales between April and September 2025, with 10-year bonds making up over 25% of total issuance, up 200 basis points from last year. This higher supply is expected to steepen the yield curve as 10-year yields rise. Meanwhile, the issuance of ultra-long bonds (30-50 years) has been reduced to 35% from 38%, addressing market concerns over demand for long-duration securities. A mild steepening of the yield curve is expected ,influenced by these supply shifts and favorable liquidity conditions expected in the April-June quarter.

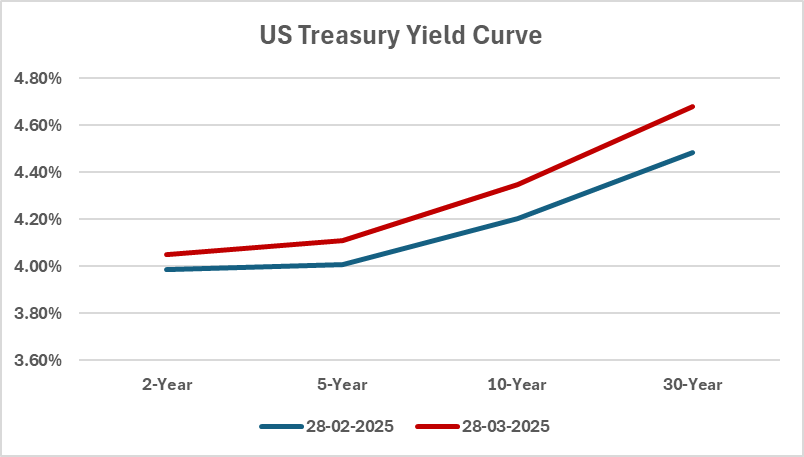

- The US PCE price index rose 0.3% month-over-month in February 2025, maintaining the pace of the previous two months and meeting expectations. Goods prices increased 0.2% (vs. 0.5% in January), while services rose 0.4% (vs. 0.2%). The core PCE index, excluding food and energy, climbed 0.4%, the highest since January 2024, exceeding forecasts of 0.3%. Food prices remained steady (vs. 0.3% prior), and energy rose 0.1% (vs. 1.3%). Year-over-year, PCE inflation held at 2.5%, in line with forecasts, but core PCE increased to 2.8%, above expectations and January’s upwardly revised 2.7%.

- With core PCE inflation running hotter than expected, the Federal Reserve faces a challenging dilemma. After reducing rates by a full percentage point in 2024, the Fed has taken a cautious approach in 2025, keeping interest rates unchanged. However, persistent inflationary pressures in the latest data could push back expected rate cuts.

- The EU is exploring concessions to ease US tariffs impacting its exports, which are set to rise after April 2. In Washington meetings, officials learned new auto and reciprocal tariffs from Trump’s administration are unavoidable. Talks have started on a potential deal to reduce them.

Market Data | |||

Particulars | 28/3/2025 | 21/3/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.59% | 6.63% | -4 bps |

Banking Liquidity (in Rs Billion) | -13030 | -232958 | -94.41% |

5 Yr OIS (%) | 5.94% | 5.87% | 7 bps |

1 Yr OIS (%) | 6.08% | 6.09% | -1 bps |

INRBonds Retail High Yield Index | 10.07% | 10.23% | -16 bps |

Nifty | 23,519 | 23,350 | 0.73% |

10 Yr SDL | 7.01% | 7.15% | -14 bps |

91 Day T-Bill (%) | 6.52% | 6.51% | 1 bps |

182 Day T-Bill (%) | 6.52% | 6.61% | -9.01 bps |

10 Yr US Treasury Yield (%) | 4.25% | 4.25% | 0.3 bps |

US Junk Bond Yield (%) | 7.38% | 7.19% | 19 bps |

Brent Crude Oil (In USD per Barrel) | 72.41 | 71.61 | 1.12% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

11.85% Navi Technologies Limited | 17/5/2026 | 11.30% | |

9.30% SMFG India Credit Company | 8/6/2028 | 9.01% | |

9.50% 360 One Prime Limited | 16/1/1935 | 9.41% | |

10.40% Clix Capital Services Private Limited | 12/6/2025 | 10.45% | |

11.70% Varthana Finance Private Limited | 6/8/2027 | 12.85% | |

Currency Market Data | |||

Particulars | 28/3/2025 | 21/3/2025 | Change |

USD/INR | 85.534 | 85.99 | -0.53% |

DXY | 104.04 | 104.09 | -0.05% |

USD/ Brazil Real | 5.62 | 5.57 | 0.90% |

EUR/ USD | 1.0827 | 1.0814 | 0.12% |

USD/CNY | 7.2628 | 7.2486 | 0.20% |

USD/JPY | 149.81 | 149.31 | 0.33% |

USD/ Russian Ruble | 84.9455 | 84.4955 | 0.53% |