Weekly Market Highlights:

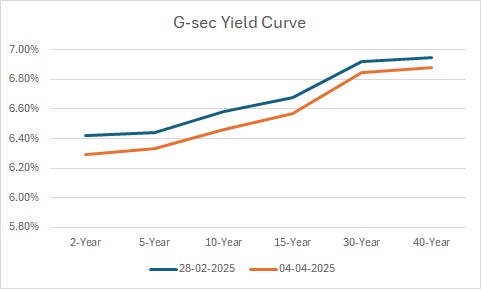

- The 10-year 2034 G-sec yield closed 11 bps down to 6.48% for the week. MENTION Y WAS IT DOWN??

- The 3M and 6M T-bill auction data yields softened to 6.30% and 6.29% respectively.

- The INR Bonds High Yield Retail Index stood at 10.07%, down 16 bps fortnightly.

- India’s foreign exchange reserves rose by USD 6.6 billion to USD 665.4 billion in the week ending March 28, marking the highest jump in nearly five months and the fourth consecutive weekly gain, according to RBI data. Reserves have surged by $20.1 billion over the past three weeks. The increase follows a period of decline attributed to weakened foreign investor sentiment in Indian equities. As of March 28, gold reserves stood at USD 77.8 billion, while foreign currency assets were at USD 565 billion.

- In its February 7 policy meeting, the RBI’s Monetary Policy Committee cut the repo rate by 25 basis points from 6.5% to 6.25%, marking the start of a new easing cycle. Markets expect another 25 bps cut in April 2025, with a total of at least 100 bps reductions through the cycle. The RBI is projected to cut rates in February and April, pause in June, and potentially resume cuts in August. However, the report warns of challenges in deposit mobilization due to low tax-adjusted returns and a shift toward Just-In-Time (JIT) liquidity management.

- Since the start of CY25, the debt market has witnessed FPI inflows of ₹56,000 crore, while equities have seen outflows of ₹1.26 lakh crore. With Trump's tariffs and rising global volatility, markets are expected to remain cautious, as continued FPI selling could intensify.

- U.S. junk bonds led the steepest global high-yield debt selloff since 2020, as sweeping American tariffs sparked fears of a global growth slowdown. The risk premium on high-yield debt over Treasuries jumped 45 basis points to 386 bps. Lower-rated U.S. bonds saw an even sharper spike, with spreads widening 53 basis points to 387 bps—outpacing similar debt in Asia and Europe.

- Investors reacted swiftly, pulling money from high-yield ETFs and increasing hedges through put options. Leveraged loan prices in the U.S. and Europe also declined amid the turmoil. While credit markets had remained relatively stable in recent weeks compared to equities, sentiment has shifted, with investors now increasingly concerned about how new tariffs might strain borrowers' ability to repay, potentially pushing spreads even wider.

POIN 8 SAYS SPREADS ROSE AND POINT 9 CONTRADICTING NO?

- On Saturday, former President Donald Trump defended sweeping new tariffs, warning of short-term pain but promising long-term economic gains. His 10% "baseline" tariff, effective just after midnight, targets most U.S. imports except those from Mexico and Canada. Trump invoked emergency economic powers, citing unfair trade practices and large deficits caused by a lack of reciprocity and high foreign value-added taxes.

TALK ABOUT MONDAY OPENING OF EQUITIES AND VIX

Market Data | |||

Particulars | 4/4/2025 | 28/3/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.48% | 6.59% | -11 bps |

Banking Liquidity (in Rs Billion) | -216118 | -13030 | 1558.62% |

5 Yr OIS (%) | 5.73% | 5.94% | -21 bps |

1 Yr OIS (%) | 5.91% | 6.08% | -17 bps |

INRBonds Retail High Yield Index | 10.07% | 10.07% | 0 bps |

Nifty | 22,904 | 23,519 | -2.62% |

10 Yr SDL | 6.84% | 7.01% | -17 bps |

91 Day T-Bill (%) | 6.30% | 6.52% | -22 bps |

182 Day T-Bill (%) | 6.29% | 6.52% | -22.49 bps |

10 Yr US Treasury Yield (%) | 4.00% | 4.25% | -25.3 bps |

US Junk Bond Yield (%) | 7.80% | 7.38% | 42 bps |

Brent Crude Oil (In USD per Barrel) | 65.95 | 72.41 | -8.92% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

10.02% Ugro Capital Limited | 7/8/2026 | 11.68% | |

10.60% Navi Finserv Limited | 10/9/2026 | 11.25% | |

9.25% Motilal Oswal Financial Services Limited | 3/9/1932 | 9.18% | |

9.65% Arka Fincap Limited | 27/12/2028 | 10.60% | |

9.70% U.P Power Corporation Limited | 4/7/1931 | 9.66% | |

Currency Market Data | |||

Particulars | 4/4/2025 | 28/3/2025 | Change |

USD/INR | 85.502 | 85.534 | -0.04% |

DXY | 103.02 | 104.04 | -0.98% |

USD/ Brazil Real | 5.69 | 5.62 | 1.25% |

EUR/ USD | 1.0955 | 1.0827 | 1.18% |

USD/CNY | 7.2813 | 7.2628 | 0.25% |

USD/JPY | 146.9 | 149.81 | -1.94% |

USD/ Russian Ruble | 84.4955 | 84.9455 | -0.53% |