Weekly Market Highlights:

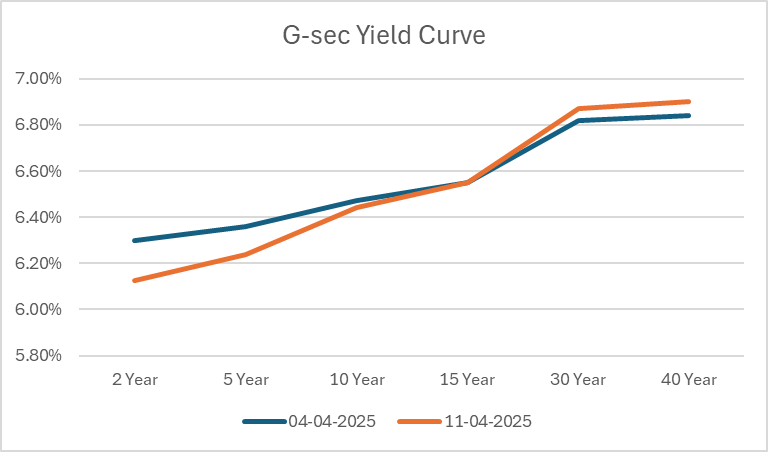

RBI’s shift to an accommodative stance—marked by rate cuts and active liquidity support—is expected to drive a further decline in G-Sec yields, enhancing monetary policy transmission and supporting domestic demand. The planned infusion of Rs 400 billion into the banking system via bond purchases in April 2025 shows that RBI is proactively targeting a surplus of around Rs 2 trillion (1% of total deposits). This liquidity cushioning is likely to boost credit flow and stabilize market sentiment.

Markets are closely watching India’s upcoming CPI data, with expectations of it coming in around 4%, well within the RBI’s target range. This is likely to be driven by easing food prices and a gradual recovery in both urban and rural demand, signaling a stable inflationary environment. However, external headwinds remain a concern. Escalating global trade tensions and a deepening economic slowdown could dampen India’s growth momentum. Yet, potential softening in global commodity and crude oil prices may help ease imported inflation pressures. On the external balance front, India’s strong net services exports and resilient remittance inflows are expected to provide a steady offset to the persistent trade deficit

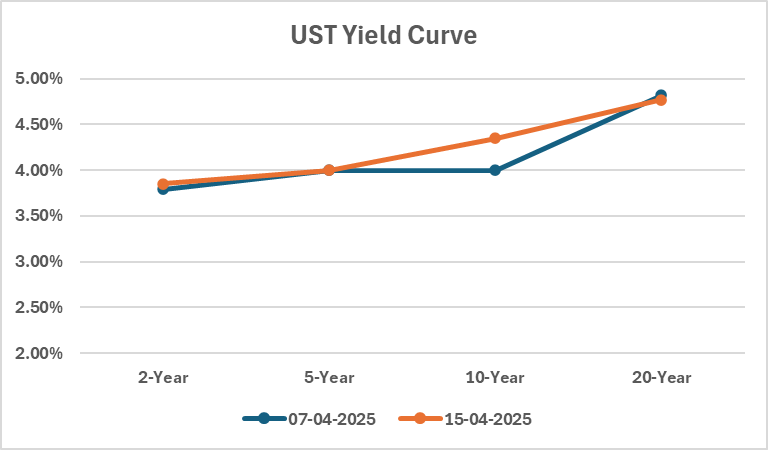

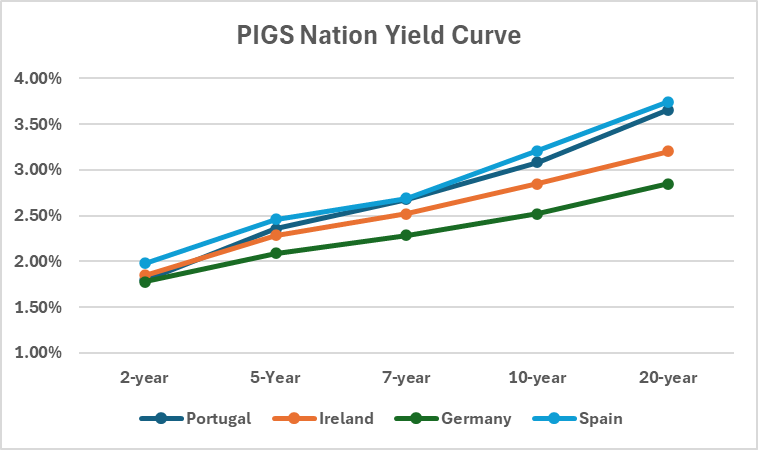

U.S. Treasuries have seen a sharp sell-off, with the 10-year yield spiking from ~3.85% to over 4.5%, driven by hot inflation, resilient labor data, and tariff-driven geopolitical tensions—dimming hopes for near-term Fed rate cuts. China, the second largest foreign holder of UST, started dumping it in retaliation of tariffs. Meanwhile, European bonds are gaining favor as softer inflation and a dovish ECB outlook fuel expectations of mid-year rate cuts. With growing yield differentials and more policy stability, investors are increasingly rotating into Eurozone debt like German Bunds and French OATs, making them more attractive than their U.S. counterparts. If global yields remain elevated, the rising cost of capital can weigh on valuations—particularly in rate-sensitive sectors such as banking, real estate, and automobiles.

Waning global confidence in the U.S. Treasury has led to a sharp decline in the DXY, now hovering near 3-year lows. A weaker dollar eases import costs and boosts capital inflows, strengthening the rupee. This currency tailwind, coupled with softer inflationary pressure, is expected to enhance foreign inflows and further boost the debt market. Safe-haven asset, gold reached record highs as central banks have been actively purchasing gold amid political uncertainties, despite high prices. The World Gold Council’s annual survey reveals that many central banks plan to continue adding to their reserves this year

Market Data | |||

Particulars | 11/4/2025 | 4/4/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.44% | 6.48% | -4 bps |

Banking Liquidity (in Rs Billion) | 1860.9 | 2161.2 | -13.90% |

5 Yr OIS (%) | 5.78% | 5.73% | 5 bps |

1 Yr OIS (%) | 5.71% | 5.91% | -20 bps |

INRBonds Retail High Yield Index | 10.07% | 10.07% | 0 bps |

Nifty | 22,829 | 22,904 | -0.33% |

10 Yr SDL | 6.84% | 6.84% | 0 bps |

91 Day T-Bill (%) | 6.03% | 6.30% | -27 bps |

182 Day T-Bill (%) | 6.98% | 6.29% | 69.1 bps |

10 Yr US Treasury Yield (%) | 4.50% | 4.00% | 49.7 bps |

US Junk Bond Yield (%) | 8.46% | 7.80% | 66 bps |

Brent Crude Oil (In USD per Barrel) | 64.76 | 65.95 | -1.80% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

10.15% Indostar Capital Finance Limited | 27/8/2027 | 10.05% | |

9.5% Cholamandalam Investment and Finance Company Limited | 22/8/1934 | 9.60% | |

9.02% Sammaan Capital Limited | 19/3/2028 | 9.23% | |

10.2% Krazybee Services Private Limited | 19/12/2025 | 12.00% | |

9.6% IIFL Samasta Finance Limited | 21/6/2026 | 11.24% | |

Currency Market Data | |||

Particulars | 11/4/2025 | 4/4/2025 | Change |

USD/INR | 86.101 | 85.502 | 0.70% |

DXY | 99.84 | 103.02 | -3.09% |

USD/ Brazil Real | 5.8671 | 5.69 | 3.11% |

EUR/ USD | 1.135 | 1.0955 | 3.61% |

USD/CNY | 7.2994 | 7.2813 | 0.25% |

USD/JPY | 142.84 | 146.9 | -2.76% |

USD/ Russian Ruble | 84.997 | 84.4955 | 0.59% |