Weekly Market Highlights:

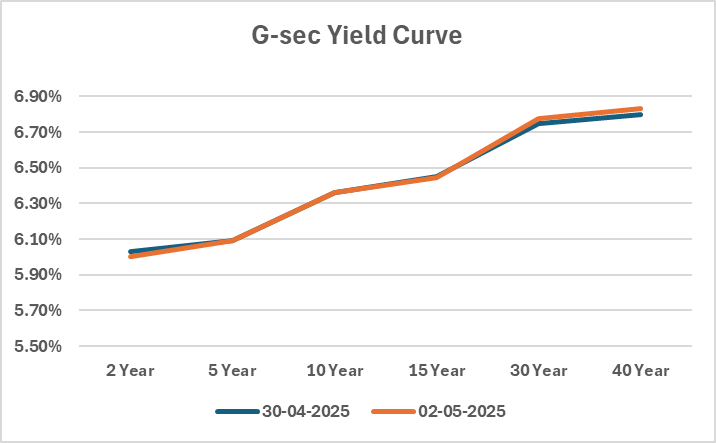

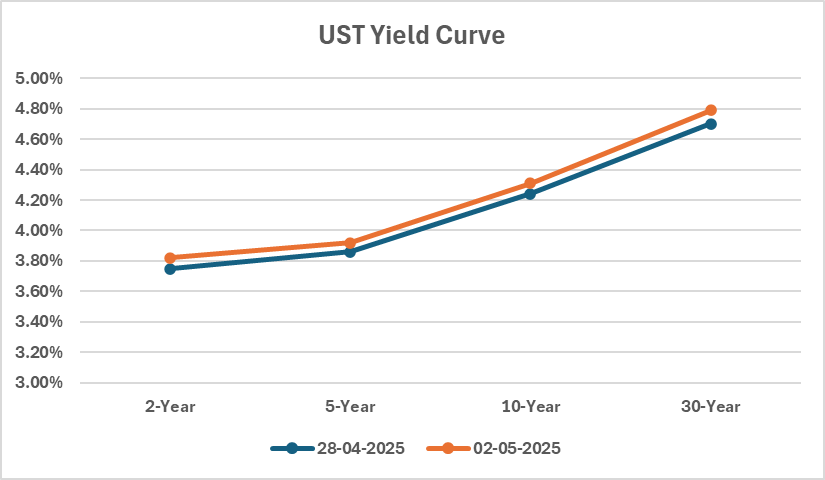

India’s G-sec market is set to take cues from upcoming PMI data and the RBI’s OMO purchase. While domestic factors guide sentiment, global developments remain influential. Weak U.S. job data last week has shifted focus to the upcoming nonfarm payroll and unemployment figures, which are expected to drive U.S. Treasury yields. Ongoing trade tariff concerns are also keeping global investors cautious, prompting a flight to safe-haven assets like gold. These factors combined will shape the near-term trajectory for Gsecs amid a bullish steepening.

In Q4 FY25, India’s BFSI sector is showing mixed performance with strong results from major players. ICICI Bank’s net profit rose 18% YoY to Rs 126.3 billion, supported by healthy loan growth and a stable NIM of 4.41%, while Axis Bank reported Rs 71.18 billion profit, driven by higher net interest income and improved asset quality. Yes Bank saw a 63% profit surge due to lower provisions, whereas IDFC First Bank’s profit fell 58% amid microfinance stress. Among NBFCs, Bajaj Finance posted a 17% profit rise to Rs 44.8 billion on strong AUM and loan growth, and PNB Housing Finance recorded a 25% increase to Rs 5.5 billion, backed by housing demand and better asset quality. However, microfinance faced headwinds, with Five Star reporting lower collection efficiencies following Karnataka’s law against coercive recoveries—now echoed by Tamil Nadu. Lenders expect this impact to be short term, with normalization likely in coming quarters.

FPI activity in India’s debt market remained volatile in 2025. After modest Q1 inflows of Rs 7.79 billion, April saw sharp outflows of Rs 189 billion—the highest since May 2020—driven by global yield swings, geopolitical tensions, and shifting rate expectations. Despite this, the medium-term outlook stays cautiously optimistic, supported by resilient macro fundamentals.

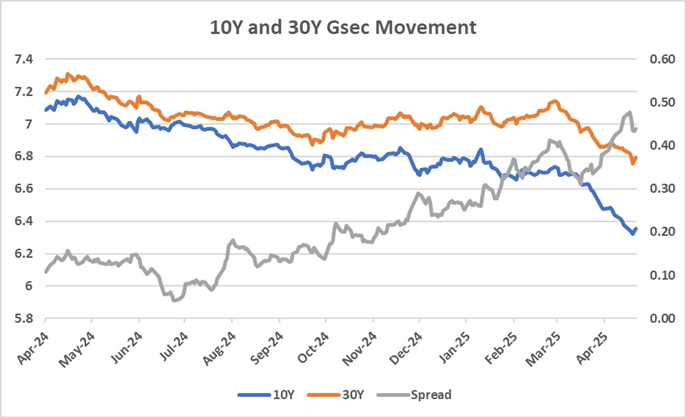

The 10Y-30Y G-Sec spread has widened notably over the past year, increasing from around 10 basis points to nearly 45 bps. This steepening of the yield curve indicates growing caution in the bond markets about pushing long-term yields significantly lower. While the market has remained bullish on G-Secs—with yields gradually declining and the curve shifting lower—the steepening trend highlights resistance at the long end. The 10-year G-Sec yield is nearing its pandemic-era lows, whereas the 30-year yield seems to be facing downward resistance, potentially marking the final phase of the current G-Sec rally.

The yield spread between India’s 10-year G-sec (6.36%) and the U.S. 10-year Treasury (4.31%) stands at about 205 bps, after briefly dipping below 200 bps—the lowest in 20 years. This narrowing reflects falling Indian yields amid RBI’s accommodative stance and rate cuts, signaling investor confidence in India’s macro stability. However, the spread may widen if U.S. yields rise due to escalating trade tensions, potentially impacting domestic rates.

The Fed is expected to maintain its benchmark interest rate at 4.25%–4.5% during Wednesday's meeting, continuing its "wait and see" approach amid economic uncertainties. Despite stable inflation and strong employment data, concerns persist over potential impacts from President Trump's recent tariffs, which could simultaneously elevate prices and suppress job growth. While markets anticipate possible rate cuts starting in July if economic conditions deteriorate, the Fed remains cautious. Chair Jerome Powell's post-meeting remarks will drive UST in the coming week. This expected pause in rate cuts could keep the FPI inflows stable and might even lead to slight appreciation of the Rupee.

Market Data | |||

Particulars | 2/5/2025 | 28/4/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.36% | 6.36% | -1 bps |

Banking Liquidity (in Rs Billion) | 1253 | 1370 | -8.54% |

5 Yr OIS (%) | 5.59% | 5.67% | -8 bps |

1 Yr OIS (%) | 5.63% | 5.71% | -8 bps |

INRBonds Retail High Yield Index | 9.69% | 9.76% | -7 bps |

Nifty | 24,346 | 24,175 | 0.71% |

10 Yr SDL | 6.70% | 6.76% | -6 bps |

91 Day T-Bill (%) | 5.90% | 5.90% | 0 bps |

182 Day T-Bill (%) | 5.93% | 5.95% | -2 bps |

10 Yr US Treasury Yield (%) | 4.22% | 4.24% | -2 bps |

US Junk Bond Yield (%) | 7.62% | 7.66% | -4 bps |

Brent Crude Oil (In USD per Barrel) | 61.43 | 65.96 | -6.87% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.49% Kerala Infrastructure Investment Fund Board | 25/3/1932 | 9.83% | |

10.90% Earlysalary Services Private Limited | 4/1/2027 | 12.75% | |

9.80% IKF Finance Limited | 26/9/2027 | 10.50% | |

10.50% Vivriti Capital Limited | 6/9/2025 | 9.55% | |

10.45% Muthoot Fincorp Limited | 11/3/1933 | 11.27% | |

Currency Market Data | |||

Particulars | 2/5/2025 | 28/4/2025 | Change |

USD/INR | 84.53 | 85.346 | -0.96% |

DXY | 100.2 | 99.62 | 0.58% |

USD/ Brazil Real | 5.68 | 5.54 | 2.53% |

EUR/ USD | 1.1296 | 1.1361 | -0.57% |

USD/CNY | 7.2714 | 7.2959 | -0.34% |

USD/JPY | 144.95 | 143.59 | 0.95% |

USD/ Russian Ruble | 82.75 | 82.62 | 0.16% |