Weekly Market Highlights:

India’s bond market remains stable despite rising tensions with Pakistan and global concerns like tariff wars and stagflation risks in the U.S. While earlier escalations triggered bond yield spikes, RBI is expected to maintain liquidity and avoid knee-jerk tightening. Indian markets to be driven by Fed speech, U.S. jobs data, and India’s CPI inflation. The Fed’s cautious stance has heightened sensitivity to economic indicators, while strong U.S. job growth and a 4.2% unemployment rate show resilience. At home, April CPI is expected to fall to ~3.2%, a 6-year low, on the back of easing food and core inflation—well below RBI’s 4% target. This mix of soft inflation and supportive global cues may lift sentiment in equities and bonds, opening room for improved FPI flows.

US initial jobless claims are expected to decline slightly to around 220,000, down from 228,000 the previous week. This continues a trend of a stable and resilient labor market, with the four-week average hovering near 227,000, indicating tight employment conditions ahead of the May 15 report.

RBI’s easing of FPI norms in corporate debt, backed by strong reserves (USD 688.13 bn) and manageable external debt, suggests it is well-positioned to manage currency volatility. The move may deepen bond market liquidity and attract more long-term foreign capital, though geopolitical risks could keep near-term FPI inflows volatile.

RBI’s ongoing liquidity infusion is likely to keep yields stable or slightly lower. Banks, despite tight liquidity, are in better shape with gross NPAs near a 14-year low of 2.5%. Credit growth has slowed to ~11%, and deposit growth remains weak, but banks could ramp up lending as liquidity improves. Stress persists in microfinance and unsecured lending, though early signs of stabilization are visible.

Investor demand for govt and corporate bonds remains strong, including for lower-rated segments. NBFCs are raising funds at 50–75 bps lower rates, while weaker borrowers still face elevated costs. Sentiment is positive, with focus on balance sheet strength and prudent underwriting. Overall, despite short-term risks, RBI support and sound fundamentals are keeping the bond market resilient.

The Fed’s rate cut pause has improved global risk appetite and spurred FPI inflows into Indian equities. The rupee strengthened briefly on seasonal forex inflows, but risks from global uncertainty and oil price volatility due to OPEC+ supply risks may lead to depreciation, pressuring the current account. RBI is using the Fed’s stance to maintain an accommodative policy, balancing growth and inflation. While stable U.S. rates and RBI liquidity make Indian bonds attractive, firms with foreign debt could face repayment risks if the rupee weakens further.

Market Data | |||

Particulars | 9/5/2025 | 2/5/2025 | Change |

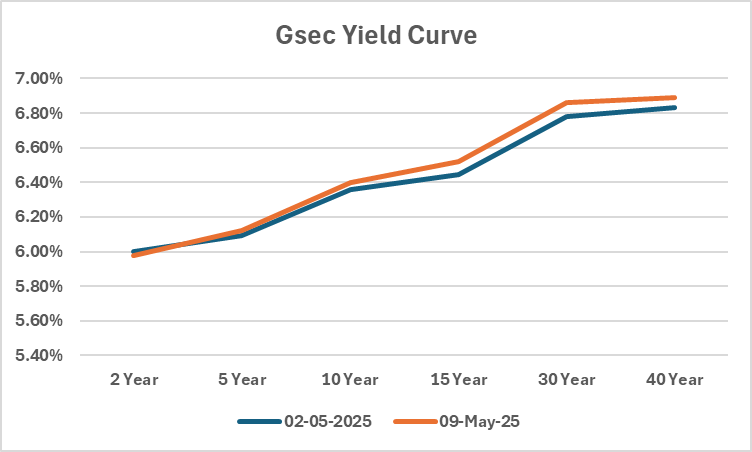

10 Yr Benchmark Gsec (%) | 6.41% | 6.36% | 5 bps |

Banking Liquidity (in Rs Billion) | 1325 | 1253 | 5.75% |

5 Yr OIS (%) | 5.66% | 5.59% | 7 bps |

1 Yr OIS (%) | 5.63% | 5.63% | 0 bps |

INRBonds Retail High Yield Index | 9.69% | 9.69% | 0 bps |

Nifty | 24,008 | 24,346 | -1.39% |

10 Yr SDL | 6.71% | 6.70% | 1 bps |

91 Day T-Bill (%) | 5.88% | 5.90% | -2 bps |

182 Day T-Bill (%) | 5.88% | 5.93% | -5 bps |

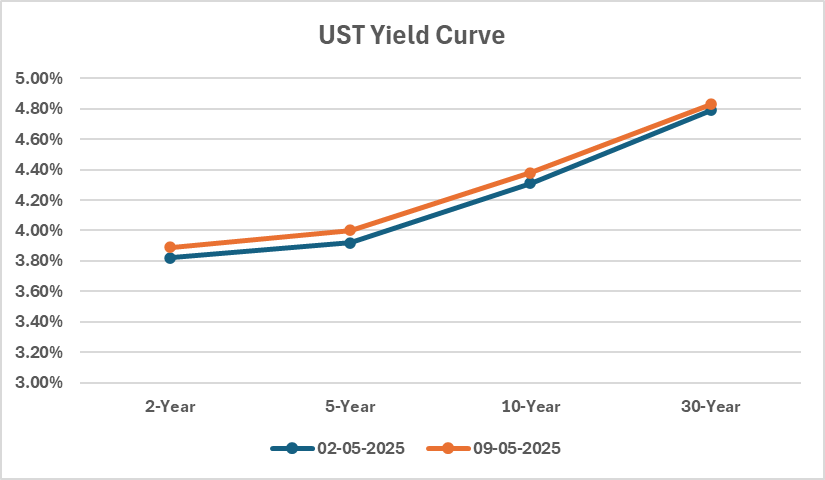

10 Yr US Treasury Yield (%) | 4.38% | 4.31% | 7 bps |

US Junk Bond Yield (%) | 7.54% | 7.62% | -8 bps |

Brent Crude Oil (In USD per Barrel) | 63.92 | 61.43 | 4.05% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.02% Sammaan Capital Limited | 19/3/2028 | 12.09% | |

9.30% IIFL Finance Limited | 21/4/2027 | 10.00% | |

9.75% Oxyzo Financial Services Limited | 19/3/2027 | 10.75% | |

9.62% Nuvama Wealth Finance Limited | 16/6/2027 | 9.65% | |

9.90% Incred Financial Services Limited | 21/8/2026 | 10.35% | |

Currency Market Data | |||

Particulars | 9/5/2025 | 2/5/2025 | Change |

USD/INR | 85.409 | 84.53 | 1.04% |

DXY | 100.34 | 100.2 | 0.14% |

USD/ Brazil Real | 5.67 | 5.68 | -0.18% |

EUR/ USD | 1.1248 | 1.1296 | -0.42% |

USD/CNY | 7.237 | 7.2714 | -0.47% |

USD/JPY | 145.36 | 144.95 | 0.28% |

USD/ Russian Ruble | 82.5 | 82.75 | -0.30% |