Weekly Market Highlights:

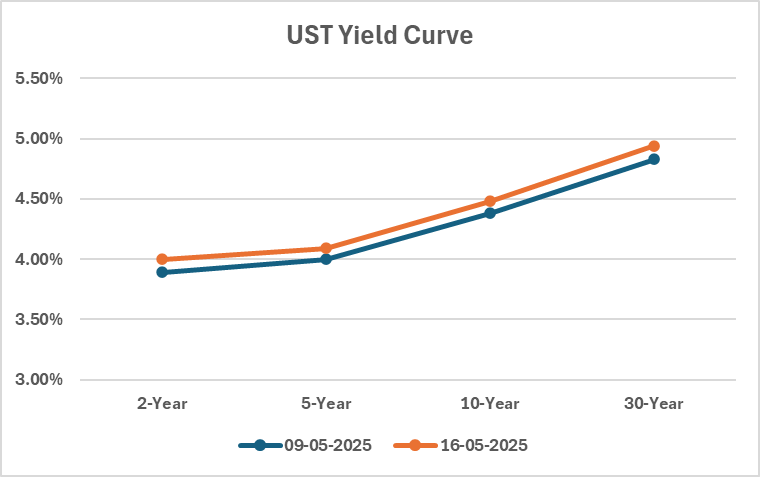

Looking ahead, global markets will closely watch Federal Reserve Chair Jerome Powell’s upcoming speeches for clarity on future US rate moves. His recent comments highlighted the Fed’s potential shift back toward a more inflation-centric framework, which could imply a prolonged higher-for-longer rate environment in the US. However, US CPI for April came in lower than expected at 3.4%, easing market concerns and pushing 10-year US Treasury yields to 4.48%—down from the April peak of 4.7%. This dovish repricing of US rates, coupled with a weakening dollar and stable oil prices, creates a favorable setup for Indian bond inflows in the near term.

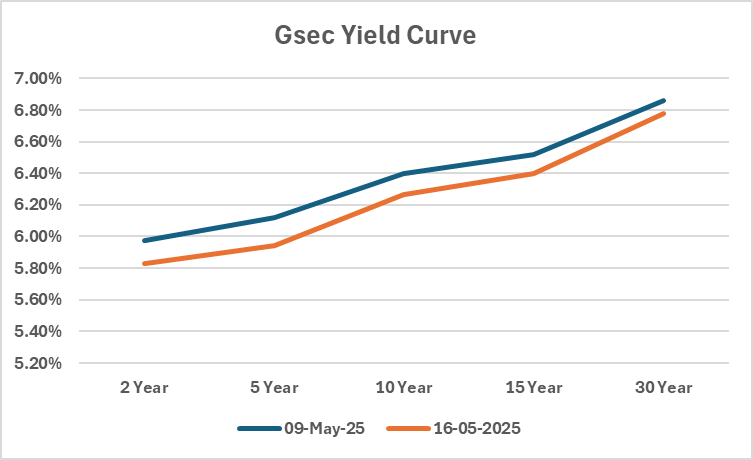

The G-Sec market is expected to maintain a stable-to-softening bias over the next week. The benchmark 10-year G-Sec yield has eased to around 6.26% (down ~14 bps over the past week), underpinned by the RBI’s dovish tone and low headline inflation. April CPI inflation fell to 3.16% YoY, with food inflation showing signs of moderation. With real policy rates well above neutral, bond markets are increasingly pricing in a 25–50 bps rate cut by the RBI in H1FY26.

From a global positioning standpoint, India continues to offer a compelling real yield differential, particularly as global funds rotate back into emerging market debt. With India’s CPI below 4% and the 10-year yield at 6.26%, the real yield stands near 225–240 bps—well above many EM peers. FPI debt flows have already turned positive in Q1FY26 (~Rs 18,000 crore net inflows). More than 80% of index-eligible bonds are already held by domestic investors, limiting volatility risks from foreign inflows. Short-term technicals suggest that bond demand may remain strong amid easing global rates and a supportive Rupee trajectory.

The recent downgrade of the United States' long-term credit rating to Aa1 over debt repayment concerns. triggered moderate upward pressure on Treasury yields. The 10-year yield rose 6 bps to 4.43% between May 9 and 16, driven by strong economic data and persistent inflation concerns. The 2-year yield—more sensitive to Fed policy expectations—increased 10 bps to 3.98%, reflecting market anticipation of possible rate hikes in late 2025. The 30-year yield climbed 6 bps to 4.89%, though demand at the long end remained resilient due to institutional buying.

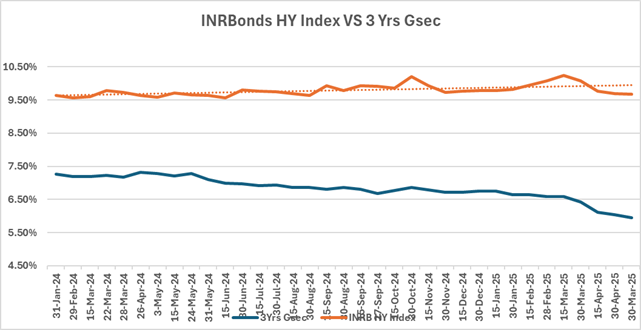

The INRBonds HY fortnight Index Yield stood at 9.68% while the 3 Yrs G-sec yield traded at 5.94%. The spreads have marginally increased from 371 basis points to 364 basis points. The Index NAV on 15th May was Rs. Rs 100.02. On 15th April the index was reconstituted to substitute Hinduja Leyland Finance with Shriram Finance since there were no trades for shorter term Hinduja Leyland Finance.

The INRBonds HY Index VS 3 Yrs Gsec graph as of 15th May is as below –

Market Data | |||

Particulars | 16/5/2025 | 9/5/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.26% | 6.41% | -14 bps |

Banking Liquidity (in Rs Billion) | 2229 | 1325 | 68.23% |

5 Yr OIS (%) | 5.65% | 5.66% | -1 bps |

1 Yr OIS (%) | 5.62% | 5.63% | -1 bps |

INRBonds Retail High Yield Index | 9.68% | 9.69% | -1 bps |

Nifty | 25,020 | 24,008 | 4.22% |

10 Yr SDL | 6.71% | 6.71% | 0 bps |

91 Day T-Bill (%) | 5.84% | 5.88% | -4 bps |

182 Day T-Bill (%) | 5.84% | 5.88% | -4 bps |

10 Yr US Treasury Yield (%) | 4.48% | 4.38% | 10 bps |

US Junk Bond Yield (%) | 7.28% | 7.54% | -26 bps |

Brent Crude Oil (In USD per Barrel) | 65.39 | 63.92 | 2.30% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.62% Nuvama Wealth Finance Limited | 16/6/2027 | 9.65% | |

9.30% IIFL Finance Limited | 21/4/2027 | 10.35% | |

9.75% Veritas Finance Limited | 25/6/2027 | 9.46% | |

10.25% Sammaan Capital Limited | 28/6/2027 | 10.55% | |

9.65% Adani Enterprises Limited | 12/9/2027 | 10.10% | |

Currency Market Data | |||

Particulars | 16/5/2025 | 9/5/2025 | Change |

USD/INR | 85.57 | 85.409 | 0.19% |

DXY | 100.7 | 100.34 | 0.36% |

USD/ Brazil Real | 5.66 | 5.67 | -0.18% |

EUR/ USD | 1.12 | 1.1248 | -0.43% |

USD/CNY | 7.21 | 7.237 | -0.37% |

USD/JPY | 145.49 | 145.36 | 0.09% |

USD/ Russian Ruble | 80.75 | 82.5 | -2.12% |