Economic Survey outlook suggests that bond yields will trend down, INR will stay stable while its outlook on growth suggests muted equity markets.

The Economic Survey 2016-17, which was tabled in the Parliament today, the 31st of January 2017, highlighted the challenges facing the Indian economy in fiscal 2017-18. Demonetization will lead to fall in GDP growth for fiscal 2016-17 to levels of 6.5% to 7%, which is below CSO estimates of 7.1%. Nominal GDP growth is expected at 10.25% to 11.25% below CSO’s estimates of 11.9%. The government will receive a one time gain on Demonetization through unreturned currency and through black money disclosure, which the survey suggests to use as a recapitalization reserve rather than spending. CPI inflation for this fiscal year as of end March 2017 is expected at below 5%

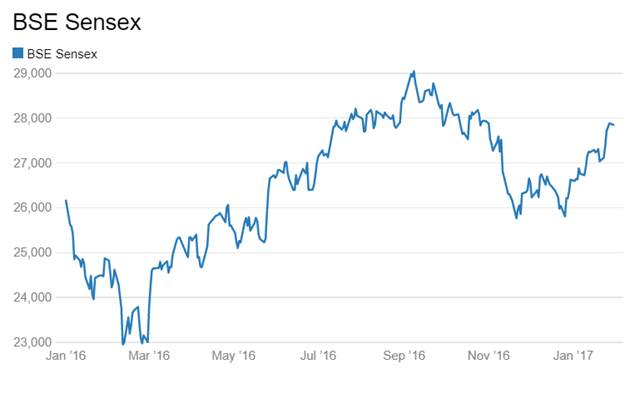

GDP growth outlook for fiscal 2017-18 is forecast at 6.75% to 7.5%, lower than the original forecast of 7.6% to 8% for fiscal 2016-17. The muted growth outlook stems from potential lingering effects of Demonetization and global macro impact on the economy.

The survey dwells on the fact that for India to grow at 8% and above, exports should grow at 15%. Export growth was negative last year and in this year, growth has just turned positive since September 2016. Global trade has been hit by weakness in the global economy and with US President Donald Trump adopting protectionist trade policies, the global trade environment could turn challenging.

Fed turning neutral on policy and better economic data globally could end a long global bond rally that is turn could affect capital flows into India.

China requires to rebalance its economy given long periods of excesses but a strong USD could make the rebalancing difficult if the Chinese Yuan continues to weaken.

On the fiscal deficit front, the survey talks about the balance between FRBM target of 3% of GDP for fiscal 2017-18 (3.5% of GDP for fiscal 2016-17) and the need to spend for growth to counter demonetization effects. Fiscal deficit target could be set higher than 3% of GDP.

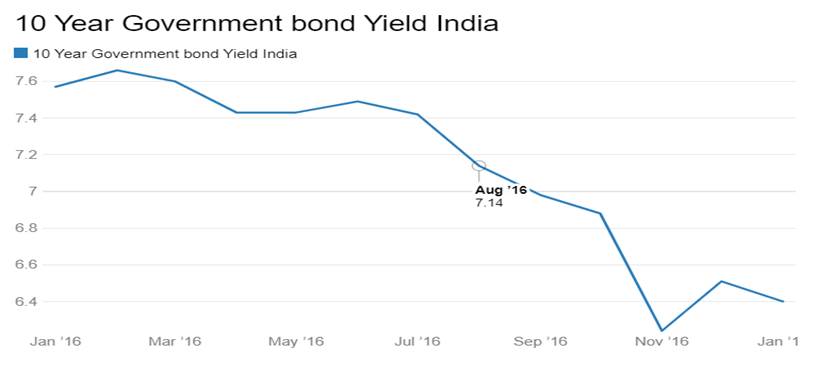

The survey believes that interest rates will come off in fiscal 2017-18 after falling by over 100bps in this fiscal year and ten year gsec yields will further trend down from current levels of 6.40%. Ten year gsec yield has fallen 130bps in this fiscal year. RBI policy would be accommodative and policy rates can be cut further.

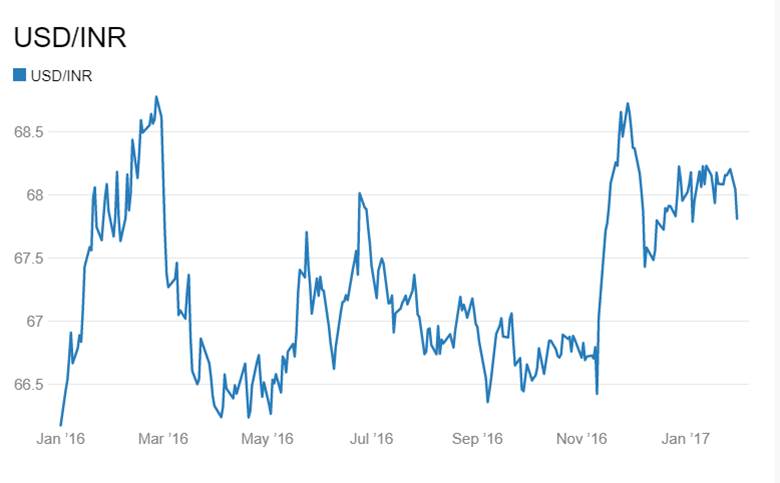

On the INR front, India’s stable macros would keep the currency stable but volatility could rise on Fed rate hikes.