Borrowing for 2018-19

The government has projected a fiscal deficit of 3.4% of GDP for the fiscal year 2019-20 from a similar fiscal deficit for the fiscal year 2018-19 (Revised Estimate from 3.3% of GDP) . The absolute level of fiscal deficit is Rs 7039.99 billion against Rs 6343.98 billion, a growth of 10.88%. The higher absolute level of fiscal deficit despite similar fiscal deficit to GDP ratio is due to growth in nominal GDP, which is pegged at 11.5% by the government.

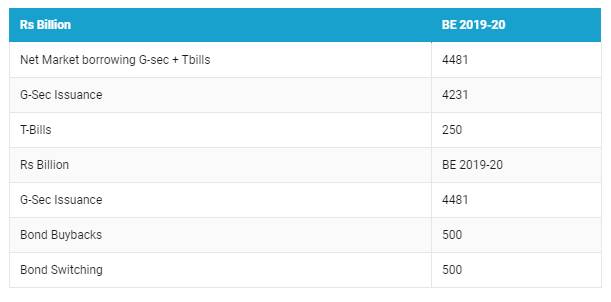

The fiscal deficit is normally financed largely by market borrowings through issue of dated government securities. Market borrowings financed 92%, 87%, 83%, 80%, 80.7% and 66.64% of the fiscal deficit in FY 2013, FY 2014, FY 2015, FY 2016, FY 2017 and FY 2018 respectively, Budgeted market borrowing for FY 2019-20 is Rs 4481 billion. Correspondingly, gross borrowing is budgeted at Rs 7100 billion (Including Buyback). The government has Budgeted for bond switches and bond buyback for Rs 500 billion each in fiscal 2019-20.

The government has shown a net market borrowing of Rs 4731 billion to finance the fiscal deficit of Rs 7039.99 billion, which is 67.20% of the fiscal deficit. The market borrowing to finance the deficit will slightly increase from the previous year’s revised level.

How can the government show such a sharp drop in net borrowings?

The increase in inflows into the NSSF (National Small Savings Fund) has changed the borrowing dynamics. The government has also discontinued investments of NSSF receipts into state government securities and all investments are made in central government securities. NSSF inflows were budgeted at Rs 750 billion for fiscal 2018-19, which were revised to Rs 1250 billion and for fiscal 2019-20, government has budgeted for Rs 1300 billion.

Government is pegging the gross borrowing at Rs 7100 billion. Bond redemptions for 2018-19 are at Rs 2360 billion.

Deducting gross borrowing of Rs 7100 and redemptions of Rs 2360 billion, net borrowing works out to Rs 4740 billion which is higher than government estimates of Rs 4481 billion. Bond buyback and switches of bonds maturing next year explains the government net market borrowings estimate.

Fiscal Deficit, Revenue Deficit and Primary Deficit

Fiscal deficit is the difference between total revenues and total expenditure of the government. Given that the Indian government spends more than it earns it runs a fiscal deficit, which is financed by market borrowings. Government borrowing every year adds to the stock of outstanding debt that is at close to Rs 50 trillion. Given rising government debt, interest cost for the government rises every year (Read our note on Expenditure Budget) that in turn puts pressure on government finances, which in turn leads to fiscal deficit, which again leads to government borrowing and increase in stock of outstanding debt. A classical self-fulfilling cycle.

Table 2 gives the Fiscal Deficit, Revenue Deficit and Primary Deficit of the Central Government.

Fiscal deficit is the difference between total expenditure and total revenue of the government while primary deficit is fiscal deficit less interest costs.

Revenue deficit is the difference between expenditure and revenue on the revenue account. Revenue expenditure does not go into creation of capital assets and hence it is non productive. Effective revenue deficit, which was introduced in 2011-12, reduces from the revenue deficit, government grants to states and other bodies for creation of capital assets.

The government is conscious of the need to bring down levels of fiscal and revenue deficits and has adopted the FRBM (Fiscal Responsibility and Budget Management) Act that sets targets for revenue and fiscal deficit as percentage of GDP. FRBM target for 2018-19 revenue deficit of 2.2%, fiscal deficit of 3.3%. Table 3.