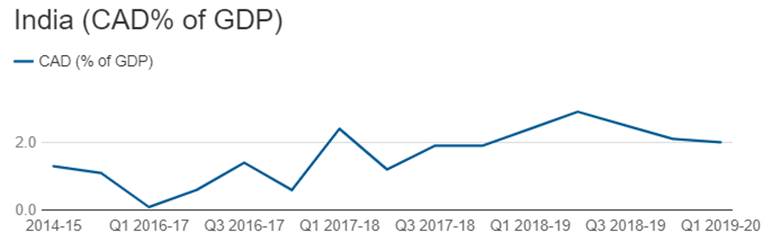

Economic Survey 2017-18 suggests higher economic growth for fiscal 2018-19 with fiscal consolidation as per the FRBM act taking a marginal step backward. However, despite fiscal deficit that could be higher than targeted, market borrowings may not rise substantially as rise in NSSF inflows fund part of the deficit. States are however choosing to access the market rather than dip into NSSF given lower cost of funds and this is leading to higher market borrowings by the state. The survey points to higher risks of sharp fall in equity prices given record high levels of equities and the fact that in comparison to US equity markets, the rise has not been with solid foundations. On the currency front, rise in REER is seen as a problem for exports.

Key Focus Points of the Survey

1. GST is a tax revolution and its most important strength is the data it will generate, which analysed and used can hugely help in government policies.

2. Government is not overly ambitious on growth, focusing more on steadying macro issues especially the TBS issue.

3. Fiscal deficit may see some slippages but not by much, this will calm markets.

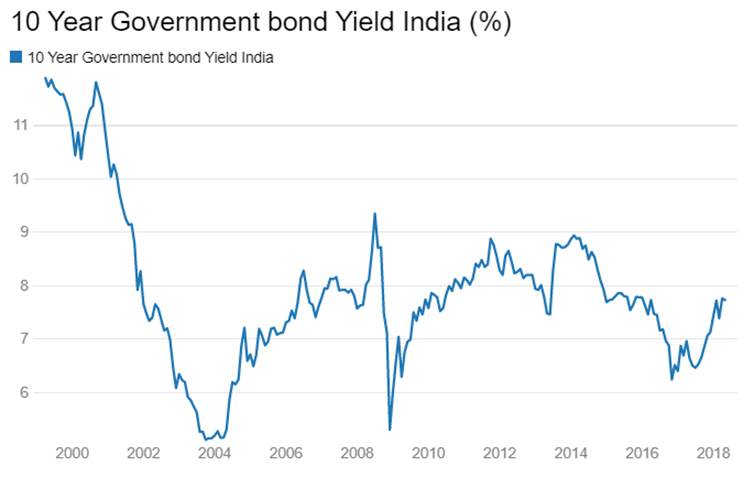

4. Fall in investments and savings is a concern and needs to be addressed more on investment side for the economy to grow.

5. Rise in gsec yields by 100bps is a worry for the government

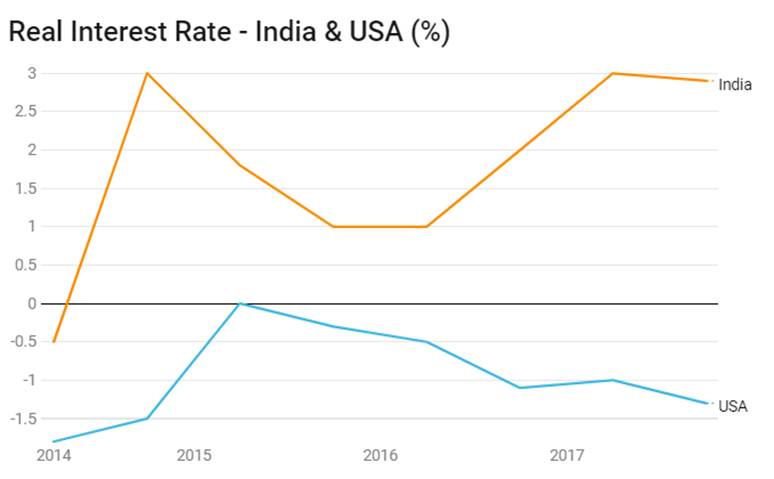

6. Real interest rates are too high

7. RBI is part of rising gsec yields problem through OMO sales and hawkish policy stance

8. High REER can impede export growth

9. Record high levels of Sensex & Nifty, while welcome for growth, is a concern if prices fall dramatically

10. Tax to GDP ratio increase stays a firm focus point

The Economic Survey 2017-18, which was tabled in the Parliament,the 29th of January 2017, mentioned the transformational Goods and Services Tax (GST), which was launched in July 2017 , as a policy change of huge scale, scope, and complexity. The transition unsurprisingly encountered challenges of policy, law, and information technology systems, affecting the informal sector. GST had brought 1.5 million additional tax payers and is seen as contributing to a sharp growth in indirect tax collections in the coming years.

Government is keen to resolve Twin Balance Sheet (TBS) problem by giving a major recapitalization package to strengthen the public sector banks and processing the major stressed companies for resolution under the new Indian Bankruptcy Code.

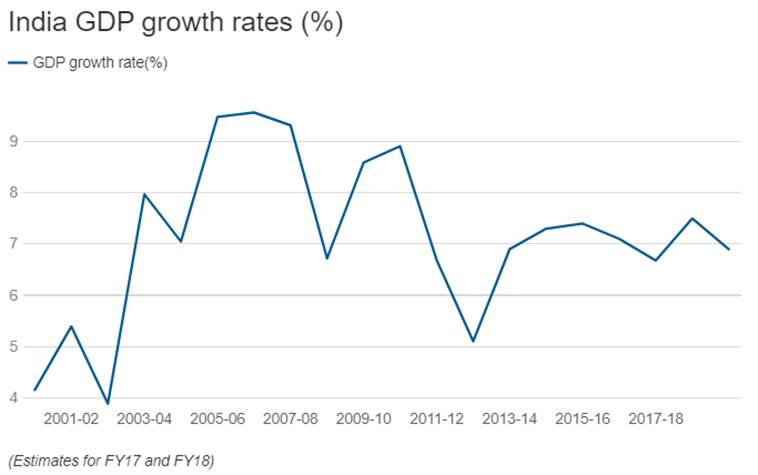

GDP growth outlook for fiscal 2017-18 expected at 6.75% while for fiscal 2018-19, GDP growth is projected to pick up at 7.00% to 7.5%. Government indicates that high oil prices, persistence and steep stock prices corrections leading to sudden stall in capital flows are impediments in the growth path. In the next fiscal year, the government will be focusing on efficiently resolving the TBS (Twin Balance Sheet) problem, stablizing the GST, privatizing Air India and maintaining macro-economic stability. Over the medium term, government will stay on its policy track ,focusing on Employment for finding good jobs for the young workforce, on Education for creating an educated and healthy labor force and on Agriculture for raising farm productivity while strengthening agricultural resilience.

Fiscal deficit as a percentage of GDP is likely to be higher than FRBM target of 3% of GDP. However, financing the fiscal deficit will not be fully through market borrowings as the government is witnessing a sharp growth in inflows into the NSSF (National Small Savings Fund).