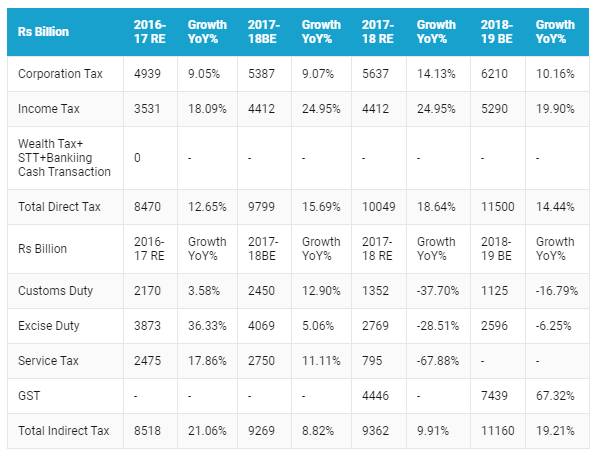

The government has budgeted for a 16% increase in total taxes with corporation tax rising by 10% and personal income tax rising by 19.9%. Tax rates for companies with a turnover of Rs 2500 million have been cut to 25% from 30% while individuals tax rate remain same as previous year.

On the indirect tax front, the government has budgeted for a 67% increase in GST collection, GST implementation brings Excise Duty and Service Tax under its fold. Union Excise duty is budgeted to grow at -6.25% this year as excise duty is expected to reduce going forward to keep fuel prices under control. Customs duty fell by -37.70% last year and is expected to fall by 16.79% this year.

On the Non-Tax Revenue front, dividends from RBI and PSU’s has been budgeted for a 0.85% increase. Demonetization in November 2016 drove liquidity up sharply leading to RBI using reverse repos to sterilize the liquidity leading to fall in revenues for the RBI. Dividend from RBI for 2018-19 is expected to grow at 0.16% in fiscal 2018-19. Spectrum auctions and license fees revenues were below budget estimates for last fiscal year but are higher by 58% for this fiscal year.

Disinvestment for last fiscal year has exceeded budget estimates , with the government grossing over Rs 1000 billion through disinvestment in the FY 2017-18, way above its disinvestment target of Rs725 billion. Disinvestment target for 2018-19 is budgeted at Rs 800 billion, a negative 20% growth.

Total non tax revenues is budgeted to grow by 0.16% largely on the fall in dividend revenues.

Gross Tax Receipts (Rs billion)

Contribution to Total Direct and Indirect Tax Revenues (Rs billion)

Non-Tax Revenue(Rs billion)