The Non-Plan expenditure of the government constitutes 65% of total government expenditure that was budgeted for fiscal 2012-13. Non-Plan expenditure was estimated at Rs 969,000 crores while total expenditure including plan expenditure was Rs 14,90,000 crores. The government has overshot its non-plan expenditure for 2012-13 by Rs 93,000 crores due to rise in its subsidy bill. Non-Plan expenditure has overshot budget estimates by 10% assuming that all other headings of non plan expenditure is on target.

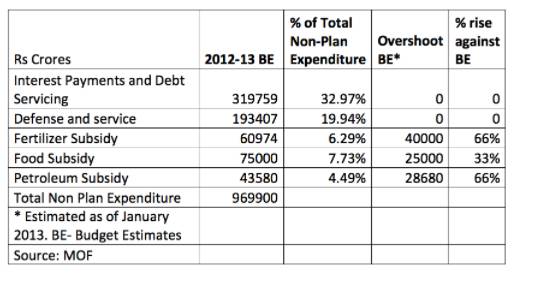

Non-Plan expenditure of the government of India is dominated by a) Interest payments and debt servicing b) Defence and c) Subsidies. Table 1 gives the fiscal 2012-13 budget estimates and the overshoots for these three headings, which account for 71.5% of Non-Plan expenditure.

Table 1. Non-Plan expenditure for fiscal 2012-13 and overshoots

The subsidy bill for 2012-13 has increased by 52% and this trend cannot be allowed to continue into fiscal 2013-14 as rising Non-Plan expenditure impacts government spending on infrastructure and capacity creating in the economy.

Interest expenses will continue to rise year on year as the government borrows from the markets every year to fund its fiscal deficit. Market borrowings fund over 90% of the government fiscal deficit and the government borrowed Rs 479,000 crores in 2012-13 for funding the deficit. The government will have to pay interest on the Rs 479,000 crores of bonds issued in the coming fiscal leading to higher interest costs. Assuming that the average cost of borrowing was around 8.2%, interest outgo for 2013-14 will increase by around Rs 40,000 crores.

Defence and services spending is sticky, as the government cannot compromise on national security. Â The government is unlikely to reduce its defence spending though it may manage to keep it from rising much higher.

It is now back to subsidies. The fertilizer and petroleum subsidy bill is largely dependent on the movement of global oil prices and oil prices rose by around 20% in 2012-13. The government has allowed oil marketing companies to set petrol prices in tune to the rise in oil prices globally. Diesel prices have also been decontrolled though in a phased manner. Oil price outlook in the global markets is soft on the back of rising oil production in the US that saw the country trade deficit fall by 21% in January 2013 on the back of lower oil imports.

Petrol and diesel price decontrol coupled with stable to soft global oil prices will help the government reduce its oil subsidy bill. The fertilizer subsidy is expected to come down by 15% in 2013-14 on the back of falling fertilizer prices globally. Fertilizer prices have come off by 15% as of January 2013 on a year on year basis.

Food subsidy is likely to increase by 20% as the government passes a food security bill in the parliament in February 2013.

Estimatefor2013-14Non-Planexpenditure

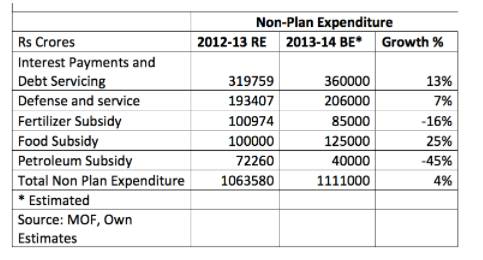

The estimate for total Non Plan expenditure is based on lower fuel and fertilizer subsidy, higher interest costs and food subsidy and a general rise in other expenses on the back of an inflation rate of 7% (Inflation as measured by the WPI is expected at 6.5% for March 2013 and is expected to go up to around 7% levels on the back of higher fuel prices).  Table 2 gives the estimate for Non-Plan expenditure for 2013-14.

Table 2. Non-Plan Expenditure Estimates

Non-Plan expenditure is expected to grow by 4% in 2013-14 against a growth rate of 19% seen in 2012-13.