Vote On Account 2014-15: GDP, Fiscal Deficit and Market Borrowings explained with actual numbers for fiscal 2012-13 and fiscal 2013-14

India’s budget for a fiscal year is usually scheduled in February every year at the budget session of the parliament. However in the years where there is a general elections scheduled where the country will vote for a government at the centre, the budget is presented post the elections that are usually held in April-May. The government will, instead of a full fledged budget that details revenues and expenditures of the government and also changes in taxes and policies present a Vote-on-Account, which is essentially seeking permission from the parliament to spend on essentials until the election is over and a government is formed at the centre.

The government presented a Vote-on-Account on the 17th of February 2014 as the country is headed towards general elections in April-May 2014. The government in its Vote-on-Account gave the fiscal year’s financial performance and projections for the next financial year

The government measures fiscal deficit as a percentage of GDP. What is the GDP measure used for calculating fiscal deficit as percentage of GDP?

Nominal and Real GDP

The government forecasts a nominal GDP growth and then arrives at the all important fiscal deficit as a percentage of GDP ratio.

Nominal GDP is not adjusted for inflation. Real GDP is nominal GDP adjusted for inflation by a metric called the GDP deflator.

GDP Deflator = (Nominal GDP/Real GDP)*100

Nominal GDP is GDP at current prices while Real GDP is GDP at constant prices (base year 2004-05).

GDP is measured at factor cost and market prices. GDP at factor cost is the money value of everything produced in the country without government involvement while GDP at market prices is GDP at factor cost + Indirect Taxes – Subsidies

Fiscal Deficit is calculated as a percentage of Nominal GDP at market prices.

GDP for 2012-13 and corresponding fiscal deficit

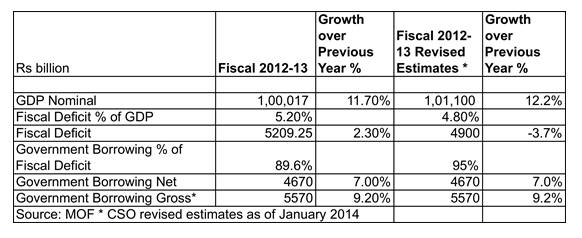

Table 1. gives the GDP, fiscal deficit and government borrowing for fiscal 2012-13

Table 1.

GDP for 2013-14 and 2014-15 and corresponding fiscal deficit

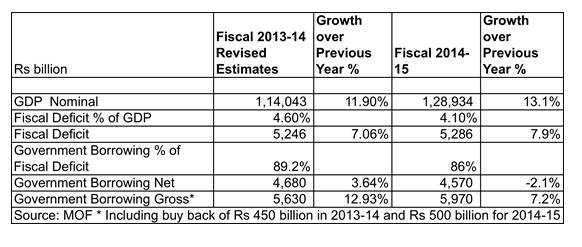

The government in its interim budget for 2014-15 has projected a fiscal deficit of 4.1% of GDP. The total fiscal deficit is estimated at Rs 5286 billion (Rs 5,28,600 crores). At 4.1% of GDP, the nominal GDP works out to Rs 1,28,934 billion, a growth of 13.1% over estimated 2013-14 GDP. Nominal GDP growth for 2012-13 was 11.9%.

The fiscal deficit is to be financed largely by market borrowings. The government is budgeted to borrow Rs 4570 billion (net of redemptions and buybacks) in fiscal 2014-15. The borrowing numbers are positive given that it is lower than 2013-14 borrowing of Rs 4680 billion, a fall of 2.1%. Table 1 gives the GDP growth, fiscal deficit and borrowing figures for 2013-14 and 2014-15.

Table 2.

Definition of Fiscal Deficit, Revenue Deficit and Primary Deficit

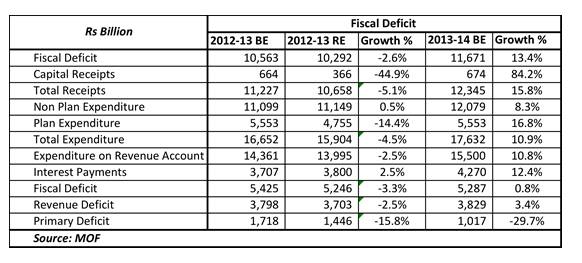

Fiscal Deficit is the difference between total revenues and total expenditure and includes recoveries of loans and other receipts such as non debt capital receipts such as disinvestments.

Revenue deficit is the difference between revenue expenditure and revenue receipts. Tax and non tax revenues less plan and non plan expenditure on the revenue account are the heads taken for calculating revenue expenditure.

Primary deficit is fiscal deficit less interest payments.

The budget details for 2013-14 is given in Table 3 for understanding fiscal, revenue and primary deficits.

Table 3.

Market Borrowings

The government issues government securities that include dated government bonds and treasury bills to fund its fiscal deficit. The government funded 95% of its fiscal deficit through market borrowings in fiscal 2012-13 and is estimated to fund 89% and 86% of its fiscal deficit through market borrowings in 2013-14 and 2014-15

The market determines the cost of borrowing for the government as it bids for government securities in government bond auctions. Higher the bids in terms of yields increase interest payout for the government while lower bids in terms of yields lowers interest payout for the government. Higher interest outgo leads to higher fiscal deficit leading to higher issue of government bonds that would take up bond yields and interest payout. It is in the government’s interest to bring down fiscal deficit.