The government is showing a fiscal deficit of 4.1% of GDP for 2014-15 against 4.6% of GDP seen in 2013-14. The government hopes to achieve a lower fiscal deficit target through revenues coming in higher than expenditures. Revenues, tax plus non tax revenues, are expected to grow at 13.4% for fiscal 2014-15 while expenditure is expected to grow at 10.9%. A marginal rise in absolute value of fiscal deficit coupled with a projected growth of 13.1% in nominal GDP will help the government achieve a lower fiscal deficit ratio.

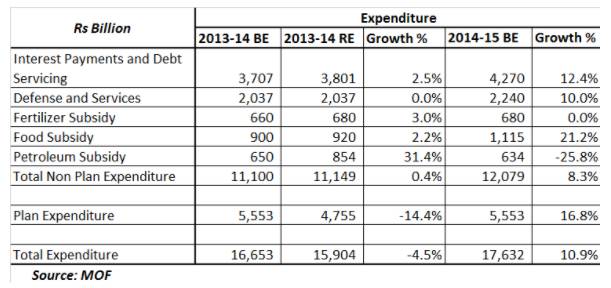

Expenditure Analysis

On the expenditure side, the government is projecting a growth of 8.3% in non plan expenditure and a growth of 16.8% in plan expenditure. Non plan expenditure grew by 0.4% in fiscal 2013-14 while plan expenditure fell by 14.4% against budget estimates. The government is effectively projecting non plan expenditure at budgeted levels of fiscal 2013-14.

On the subsidy front, fuel subsidy exceeded budget estimates by 31% while food and fertilizer subsidy exceeded estimates by 3% and 2% respectively. Food subsidy is expected to grow by 21% in fiscal 2014-15 to pay for the food security bill while fuel subsidy is expected to fall by 26%. The government has consistently missed fuel subsidy targets and if it cannot pass through oil prices to end user, the bill could well be higher in 2014-15.

Interest costs form the bulk of expenditure showing a growth of 12.4% in fiscal 2014-15. Government is consistently borrowing to fund its fiscal deficit and interest costs are bound to rise every year. Interest and subsidies as percentage of GDP are at 3.3% and 1.9% respectively.

Table 1 gives the expenditure estimates for fiscal 2014-15

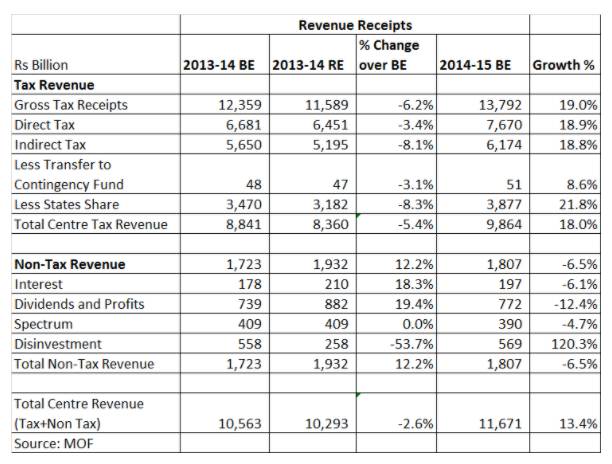

Revenue Analysis

On the revenue side, total tax revenues are expected to rise by 19% in fiscal 2014-15 against a drop of 6.2% seen in fiscal 2013-14 against budget estimates. The government has not changed direct tax numbers but has cut excise duty on automobiles, capital goods and consumer durables. Government expects an overall economic growth to push up tax collections.

A tax break up shows service tax growth to be highest at 30% while income and corporate taxes are expected to grow at 27% and 14.5% respectively in fiscal 2014-15. Service tax is emerging as a strong revenue earner for the government. In the absence of implementation of the GST (Goods and Service Tax) and a new direct tax code, the government is finding it tough to raise the tax to GDP ratio that is hovering around 10% levels for over ten years.

On the non tax revenue side, disinvestment is expected to rise by 120% in 2014-15 while revenues from spectrum auctions, interest and dividends are expected to drop. Total non tax revenue is expected to drop by 6.5%.

Table 2 gives the revenue estimates for 2014-15.

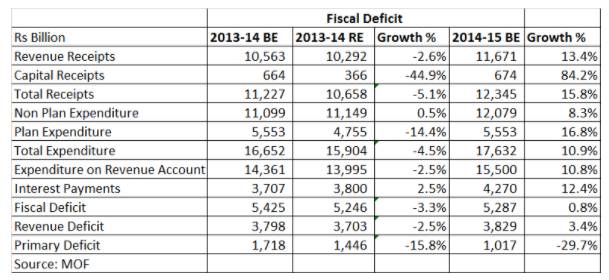

Fiscal Deficit

Fiscal deficit is expected to come in at Rs 5287 billion in fiscal 2014-15, a growth of 0.8% over fiscal 2013-14. Revenue and primary deficits are expected to grow at 3.4% and negative 29.7% respectively. Revenue deficit is slated at 2.97% of GDP. Government will have to lower revenue deficit if it has to bring down fiscal deficit as interest costs will continue to rise year on year.

Table 3 gives the fiscal deficit numbers for 2014-15.