The Railway Minister Sadananda Gowda, presenting the first Railway Budget of the Modi government, announced a lower borrowing program for IRFC (Indian Railway Finance Corporation) in this fiscal year. IRFC is the dedicated financing arm for the Ministry of Railways and is a benchmark AAA corporate bond in the INR bond market.

IRFC will borrow Rs 115 billion through issue of taxable and tax free bonds in fiscal year 2014-15 against a borrowing of Rs 147 billion seen in the last fiscal year.

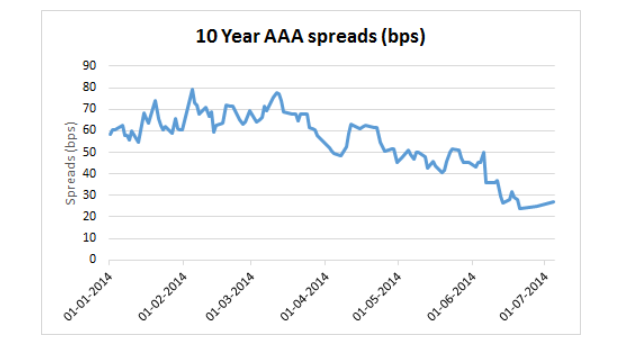

Credit spreads have come off sharply in the domestic bond market with benchmark AAA ten year spreads at levels of around 25 bps to 30 bps. Spreads were at levels of around 100bps a year ago and 50bps a couple of months back.

The reason for spreads coming off is that corporate bond private placement issuances have dropped significantly in the first three months of this fiscal with just 139 issues worth Rs 345 billion against 1473 issues worth Rs 2710 billion seen in fiscal 2013-14.

FIIs have been net buyers of INR bonds in this fiscal year with purchases of USD 5 billion and that has added demand to corporate bonds.

Lower borrowings from IRFC would lead to higher demand for the security as it becomes scarce in the market. IRFC spreads would be one of the tightest in the market as traders and investors add scarcity value to the bond.

Apart from lower borrowings for IRFC, the Railway Budget did not offer much in the way of rationalization of fares. Freight and passenger fares were raised by around 6.5% and 14.2% respectively in June as the government implemented an order passed by the previous government. However there were much needed sound bytes on infrastructure, passenger services, safety and online bookings.

Going by the Railway Budget, the Union Budget on the 10th of July is likely to be low key and not path breaking with a focus on fiscal consolidation, which would be positive for markets over a longer time frame.