The finance minister, Nirmala Sitharaman unnerved the bond markets with additional borrowing of Rs 800 billion for this fiscal year and Rs 12 trillion gross borrowing for next fiscal year. Fiscal deficit was pegged at 9.5% of GDP for fiscal 2020-21 and 6.8% for fiscal 2021-22. Fiscal deficit in absolute terms is at Rs 19 trillion for last fiscal year and is budgeted at Rs 14.6trillion for this year.

Impact on Government bonds

Net borrowing for this year works out to Rs 9.3 trillion, after bond redemptions of Rs 2.7 trillion. Market borrowing will fund around 65% of fiscal deficit.

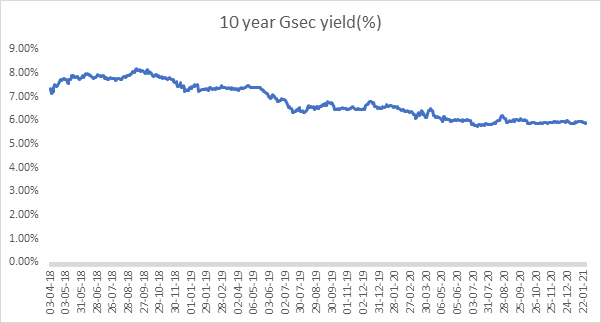

The bond market will start to factor in resistance to absorb such huge supply. Even if RBI comes in with heavy duty bond purchases and yield curve management, the market will at any opportunity push up yields. 10 year government bond has seen a floor of 5.77% and this will not be breached down over the next many years.

Impact on SDL

SDL yields will rise on rising government bond yields and spreads will widen as market turns illiquid. Heavy supply of both government bonds and SDLs will keep yields under pressure.

Impact on INR

The INR will look to factor in higher FII flows on the higher growth trajectory the budget promises with such high fiscal deficit. GDP growth is pegged at 11% for this fiscal. However, if the high deficit leads to high inflation and rise in interest rates, the INR could face weakening trends.

Impact on corporate bonds

Corporate bond yields will rise as it follows government bond yields. However at higher yields, there will be more interest as investors factor in stable credit spreads amid an economic recovery.

Impact on equities

Equities will watch for global cues and portfolio flows on the back of continued ultra low global rates. However risk is in the form of high fiscal deficit and inflation that could undermine the growth. Trend in broadly higher but can change.

We would love to hear back from you. Please Click here to share your valuable feedback