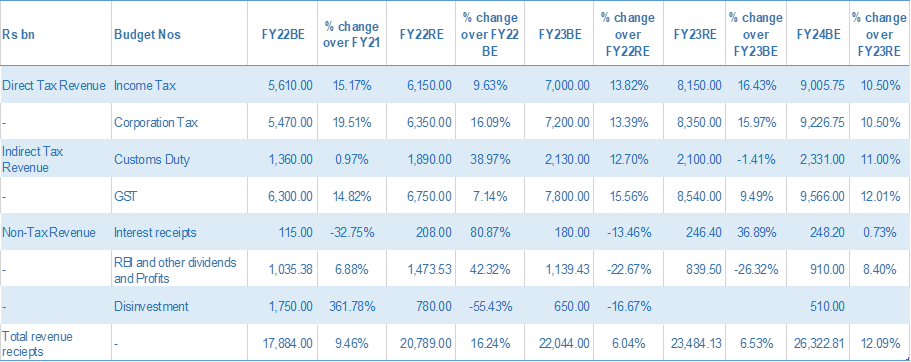

For FY24, Union Government has estimated Rs 26322.81 billion in terms of revenue receipt.

� Within the direct tax revenue category, income tax has been estimated to grow by 10.5% while corporation tax to rise by 10.50% during FY24 over the revised estimate for FY3.

� Custom duty has been budgeted to increase by 11% while revenue from GST has been estimated to increase by 12%.

� Within non-tax revenue category, interest receipts has been budgeted to stay flat at Rs 248 billion while dividend income to increase by 8.40% during FY24.

� Union Government has set target for Rs 510 billion of collection from disinvestment.