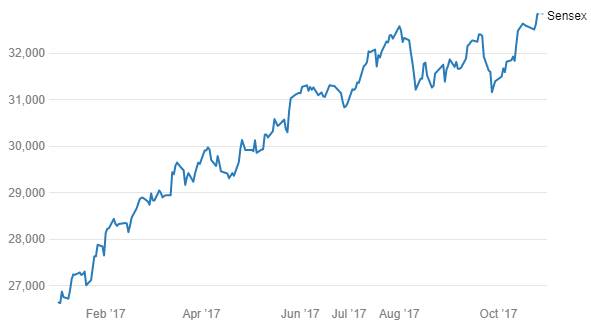

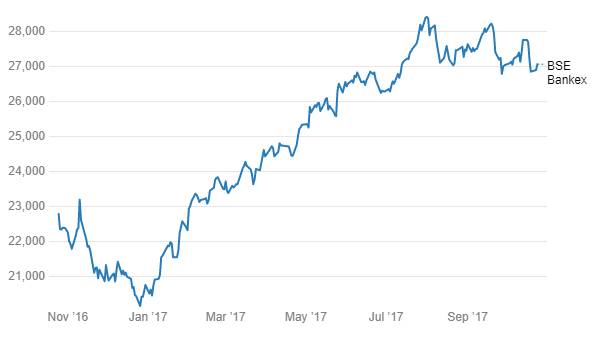

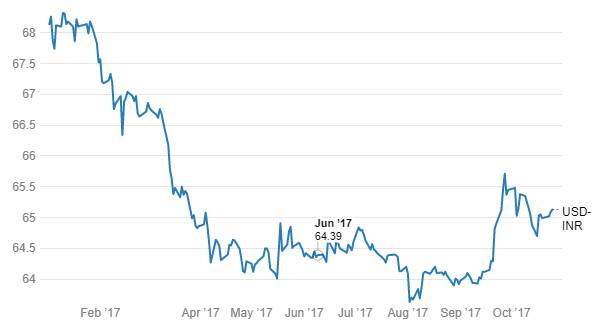

Initial market reaction to the Rs 2.11 trillion bank recapitalisation plan of the government is surge in PSU bank stocks leading the Sensex and Nifty to record highs, rise in gsec yields, fall in credit spreads of bank bonds and fall in INR. How will the recapitalisation move play out going forward? Initial market reaction is not a yard stick for the longer term impact on markets.

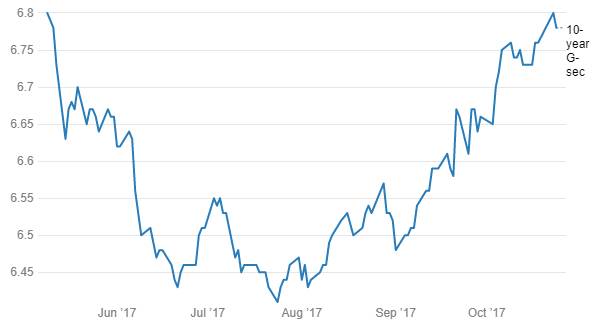

10 Year G-sec Movement

Sensex

S&P BSE Bankex

USD-INR

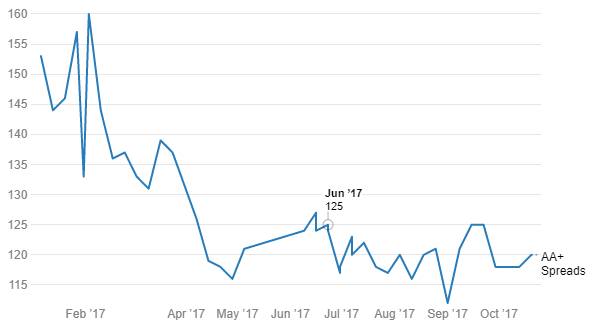

AA+ Spreads Movement

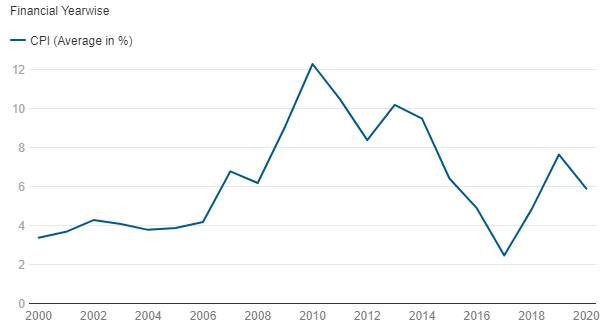

The government plan to recapitalise banks and spend on roads is definitely negative for gsec’s as it will entail higher borrowing. Government borrowing and spending can lead to higher inflation, as seen from the sharp rise in inflation to double digit levels chart 6. as government increased fiscal deficit as percentage of GDP by 300bps post 2008 global financial crisis.

CPI (Average in %) - India

Bank bonds including perpetual bonds will benefit as banks credit perception improves. Spreads will fall in relation to gsecs. Overall credit spreads will come off on the back of improved access to capital for corporates as banks look to efficiently utilise the funds. INR will see appreciation as capital flows rise on higher economic activity.

On the other hand, if government raises funds through bonds and higher borrowing, banks will tend to subscribe to the bonds on higher interest offered by the bonds and this may lead to banks staying credit risk averse, which will not benefit the economy. The government should actively look to disinvest in banks or consolidate the banks through mergers for recapitalisation benefits to play out.

Given the overall positive sentiment on risk assets globally with major global indices at record highs, improved guidance from global infra plays such as Caterpillar that indicates a global economic upturn, Sensex, Nifty and INR will see strong support. Credit spreads too will benefit from liquidity and rising equity prices. Liquidity will stay high on the back of government spending and capital flows. Gsec yields will rise and 10 year gsec yield will touch 7% from current levels of 6.8%.

Bank Recapitalisation

Central Government has announced a Rs 2,100 billion capital infusion plan for PSU banks and biggest highway construction plan to develop approximately 83,677 km of roads by 2022 with an investment of Rs 6,920 billion to boost the economy. This move comes after India’s GDP growth rate fell to 3 years low, which is well below the levels needed to create jobs for the economy to sustain itself.. Central Government has tried to step up public spending for growth and has already exhausted 96.2% of the fiscal deficit target for FY-18, making it essential that private investment picks up.

Private investment has struggled to revive, as state-owned banks that provide much of the credit in the economy, has a pile of bad debt that has reduced their ability to extend new credit. Credit growth as of 20th October 2017 is 6.9% compared with 9.1% a year ago. Bank recapitalization will clear the bank balance sheet problem and will push forward the growth.

Bank Credit Growth

Banks will get Rs 1,350 billion from bonds, Rs 180 bilion from the Budget and raise the remaining Rs 580 billion through share sales. Finance Minister Arun Jaitley said details of bonds will be announced later and the impact of the capitalisation on the fiscal deficit will depend on the nature of the bonds. Recapitalising by bonds issuance doesn’t add to the fiscal deficit other than the interest payable on the bonds, which is not likely to happen this year. However, this will add to country’s debt. The capital infusion will be spread over two years. Government has set aside Rs 100 billion for banks this fiscal year and remaining Rs 80 billion is expected to come next fiscal year, Government holding in Banks will fall due to stake sale in state-owned banks.

Currently, it is expected that the government is likely to achieve this year’s fiscal deficit target of 3.2% of GDP as interest payment on recapitalisation bonds will happen next year. Out of the Rs 180 billion budgetary support, Government has already set aside Rs 100 billion this fiscal year. Therefore, impact on 10-year G-sec will be more on future borrowing outlook and market sentiment.