Political risk rather than economic risk has been a big worry for Eurozone as seen by rising spreads between bond yields of countries facing elections. Brexit and Trump victory have given a thrust on populism and this does not bode well for both markets and economies. Centrist European Leaders are worried if Eurosceptic leaders like Wilders, Marine Le Pen in France and Beppe Grillo in Italy would come to power and if they will bring an end to the economic and political union that tied the Continent together in peace and prosperity for six decades.

Netherland General Election- General election in the Netherlands was one of the closely watched election this year because of Far right Populist candidate Geert Wilders, who has gained attention due to his populist agenda of Nexit. The result of Netherland General election is out, Prime Minister Mark Rutte will form the next coalition government, Geert Wilders party came second in the election. Centrist European Leaders will be relieved by Netherland election outcome.

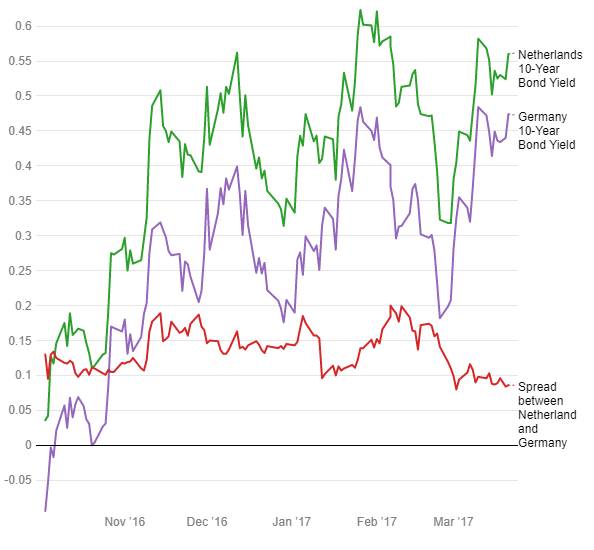

Netherlands bond yields have largely maintained the spread with German bund yields suggesting that markets are not perturbed by Nexit. If we look at the Netherland and Germany benchmark bond spread we can see spreads has remained in the range of 0.1 to 0.2% and from mid-February 2017 spreads have started to collapse, which clearly suggests markets has factored the Netherlands election outcome. However, the reason why Netherlands bond market has not panicked about Nexit is due to fact that Netherland is Triple A Rated, same as Germany, which will allow Netherland to borrow cheaply. Any worries about a Nexit that could raise Eurozone break-up risks may be more obvious in the selling off weaker countries bonds such as Italy and Portugal.

After Netherland election outcome, all eyes are on France General Election.

Netherland, Germany 10 Year Bond Yields Movements

France General Election– Post financial crisis in 2008, France has been facing sluggish economic growth. France GDP growth has remained in a range of 0% to 0.5% since 2009. High level of unemployment at around 10% and continuous threats from terrorism is causing anxiety among the French. Brexit has pushed uncertainty in the minds of the French and almost 61% of French population do not want to be the part of EU.

France is going in for general elections in April 2017 and Le Pen (French presidential candidate) has said if she wins the election she will hold a referendum to decide the country’s membership of the group within six months.

Recent polls suggest Marine Le Pen (Far-Right Candidate) and Emmanuel Macron are leading in the general election with both getting 26% of vote shares, Marine Le Pen gained attraction due to her Populist agenda while Emmanuel Macron gained attraction due to his Tax cut and Fiscal stimulus plan.

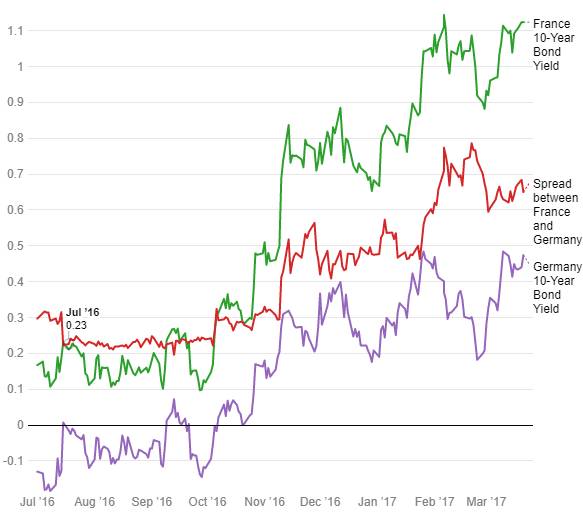

France 10-year bond yields suggests that the market is uncertain about French elections as spreads between France 10 year and Germany 10 year bond yields are rising. Unlike Netherland spreads are rising for the French bond, in January 2017 spreads were around 0.4% and in March 2017 spreads have risen to 0.65% which clearly indicates uncertainty for French election outcome.

France, Germany 10 Year Bond Yields Movement

Curious Case of German Bunds

ECB in its recent policy kept its interest rates unchanged, ECB said it will continue its asset buying program until end December 2017 or beyond if necessary. On the other hand Federal Reserve in its March policy meet raised its benchmark interest rate by 25 bps. However 10 year German bund yields have risen faster than 10 year US treasury yields, largely on the back of rising inflation in Germany.

US 10 Year Vs Germany 10 Year bond yields

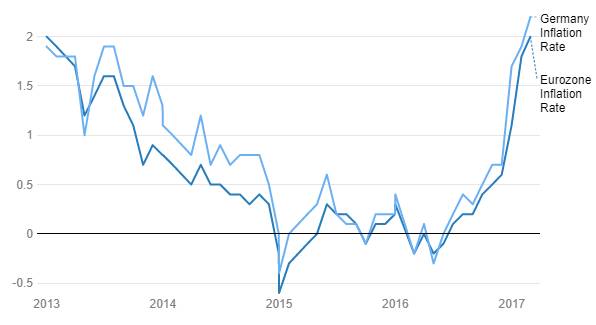

Germany CPI in February 2017 rose to 2.2%, CPI marked this reading after four years. Germany inflation has crossed the Eurozone inflation target of 2% (Chart 4)

Inflation in Germany and Eurozone

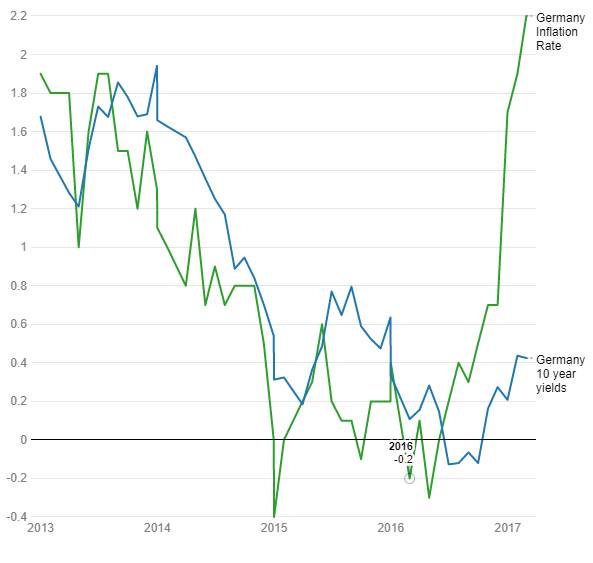

Germany Monthly Inflation Vs Germany 10 year Yield

In the Bond market, the biggest risk is inflation risk, as bonds have pre-determined interest rate from inception and if inflation increases bond holder will lose money on investments.

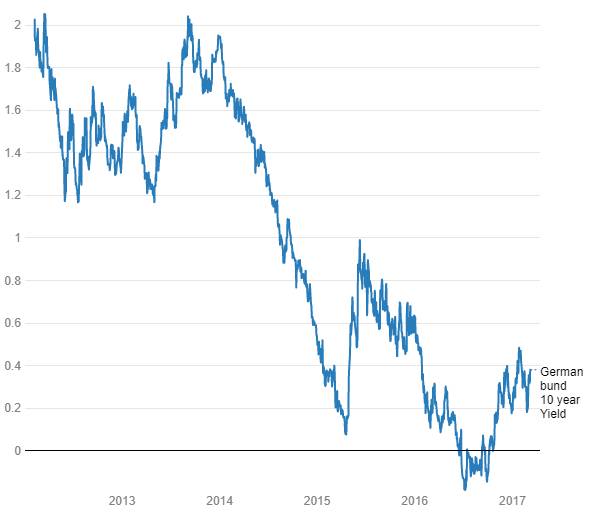

10 year German bund Yield

Main reason why yields had fallen to a record low is German bunds are treated as Benchmark Euro bonds given its economic strength. German bund is treated as Eurozone’s safest asset. Demand for German bunds has increased recently due to Brexit and upcoming French elections. 10-year Bund is yielding around 0.4%, climbing above the record low of -0.2% touched in July, but still below the 1.0% it hit in 2015. Yields on 2-year German debt has also fallen to record lows after ECB has started purchasing 2-year note with a yield below -0.4%.

Germany 2 year bond yield

With ECB still maintaining its record low-interest rate and continuing its asset purchase until December 2017, German debt will remain the attractive buy for ECB and there is less chance that Bund yields will shoot up. ECB strong presence in the Eurozone bond markets has driven yields to lows across the zone. Weak levels of core Eurozone inflation, which was unchanged at just 0.9 per cent last month, should also help support bond prices as the market is expecting that the energy-driven price rises will begin to dissipate in the coming months.