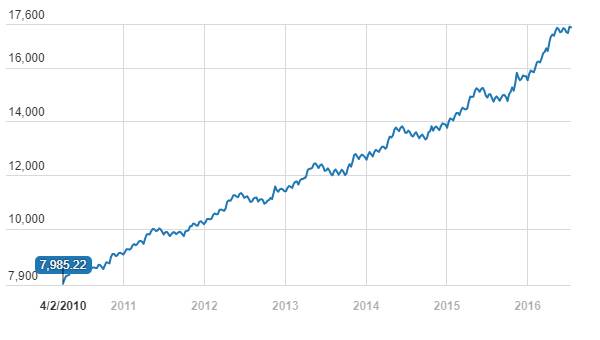

The yield on the benchmark ten year government bond, the 6.97% 2026 bond, fell 13bps post the government demonetising the Rs 500 and Rs 1000 notes. The bond yield closed at around 6.68% levels post demonetisation. The outlook for the bond yield is highly positive despite the global bond sell off post Trump victory.

The 6.97% 2026 bond saw a period of uncertainty post RBI October rate cut. The yield rose by 20bps from lows as markets worried about supply, low prospects of further rate cuts, Fed rate hike expectations and uncertainty on US election results.

6.97% 2026 G-sec yield movement

The government move on demonetisation of the Rs 500 and Rs 1000 notes has provided a fresh impetus for bond yields to fall further. The reason is that as money goes out of circulation, inflation expectations will fall sharply even as the banking system will be flushed with liquidity and bring down rates to grow credit and also buy government bonds for SLR purposes.

Of the total of around Rs 17.5 trillion of currency in circulation, around Rs 14.5 trillion is in Rs 500 and Rs 1000 notes. Even if 50% comes into banks in the form of deposits, that is a total of Rs 7.25 trillion. Banks require to hold 20.75% as SLR and that would mean incremental demand of around Rs 1.5 trillion. Banks can technically absorb 75% of the incremental bond supply of central and state government in the rest of this fiscal year.

The sharp fall in inflation expectations as currency goes out of circulation will prompt RBI to cut rates as GDP growth too will be affected temporarily. RBI rate cut expectations coupled with system flushed with liquidity will drive fown bond yields.

Rise is global bond yields will prompt global investors to shift out of low yielding bonds into higher yielding bonds that have prospects of yields falling. Indian bonds will see strong FII buying in the coming weeks.

Demonetisation of Rs 500 and Rs 1000 Notes

The demonetisation of Rs 500 and Rs 1000 notes in one stroke brings currency in circulation back into the banking system. Currency in circulation at around Rs 17.5 trillion is around 17% of total bank deposits. While estimates of undeclared income in the form of currency in circulation varies, it is seen as a substantial amount.

Banks will now be flushed with liquidity as public deposits Rs 500 and Rs 1000 notes to banks. Use of electronic money will also reduce the pace at which currency in circulation rise.

The surgical strike on black money will also lower speculation on commodities including agricultural commodities. Real estate too will see loss in value as this sector generates a lot of black money.

Fall in commodity prices will lower inflation expectations. Strong system liquidity coupled with lower inflation expectations will bring down bond yields in the short term. In the longer term, macro factors such as central and state government fiscal deficits, global commodity prices and economic growth.

Equity markets too will see a positive trend though sectors such as real estate will be hit by the strike on black money. Overall economic growth can slow as black money economic falls in size but over a longer period, economic growth will get back on track as demand supply of goods and services in the economy stabilise.

Rs 500 and Rs 1000 taken off air

Taking the nation by surprise, Prime Minister Narendra Modi announces demonetisation of Rs 1000 and Rs 500 notes, making these notes invalid in a major assault on black money, fake currency and corruption. The currency notes of Rs 1,000 and Rs 500 would be only paper, with no value, said the PM in his speech. They would cease to be legal tender from midnight of 9th November.

The surprise step appears to be designed to bring billions worth of cash in unaccounted wealth into the mainstream economy. “Black money and corruption are the biggest obstacles in eradicating poverty,” PM Modi said in his address to the nation.

For the next 50 days, up until 30th December 2016, public can deposit their old currency notes in post offices and banks. They would need to carry there Aadhaar card and PAN card for exchange of these notes.

RBI Governor in a press conference after PM Modi announcement said that it’s a bold move taken by the Government. He also said that, “Our security measures have not been breached and this is a powerful measure to combat terrorism”.

Economic Affairs Secretary Shaktikanta Das said that, the measure was necessary to maintain economic integrity of economy. It will be positive for our economy and will add to the growth of our economy.

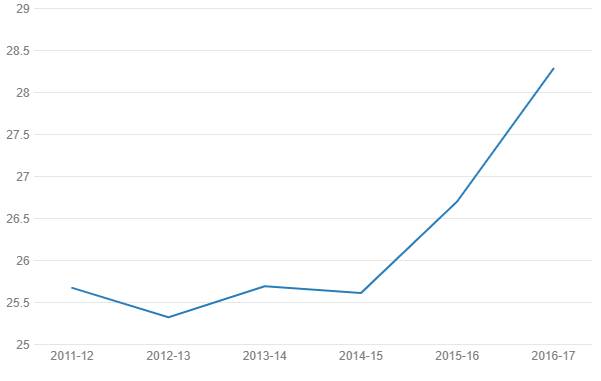

This is one among the many steps taken by the government in recent past to curb shadow economy which was running parallelly and was getting bigger as the use of cash has increased in past many years. Chart 1 depicts that the currency in circulation has only been increased. Currency in Circulation is money going out of banking system and being held as cash by the public. For example, if you draw cash from an ATM, money goes out as cash. Currency in Circulation is determined by need to hold cash for transactions and cash held as black money. Inflation affects need to hold cash as value of goods and services increase due to inflation.

The system liquidity is expected to remain high after recent measures taken by the government. System liquidity was in surplus of Rs 273 billion as of 4th November. The move is positive for the bond market as system liquidity is expected to ease further. The financial market as a whole would see this as a positive move for the economy and will attract foreign investments.

Currency in circulation -Total (In Rs billion)

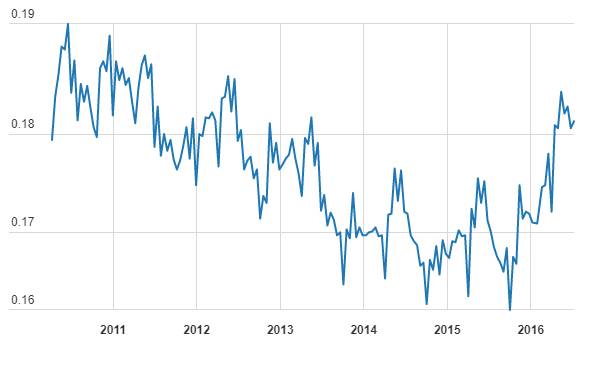

(Currency in circulation/Aggregate deposits ) - Ratio

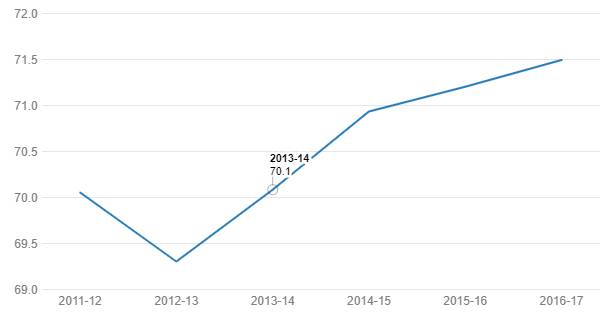

Deposit (% of GDP)

Bank Investments (% of deposit)