CPI inflation for May 2017 printed at a record low 2.18% against 2.99% seen in April. Inflation fee on the back of sharp drop in food inflation, which came in negative at 1.05% with prices of fruits, vegetables and pulses falling sharply. Core inflation came in below 4.2%. Inflation is expected to undershoot RBI forecast of 2% to 3.5% for the first half of fiscal 2017-18 leading to expectations of Repo Rate cut in RBI’s August policy review.

Bond Yields fell on the back of May inflation data with the 10 year benchmark gsec yield falling below 6.50% levels. Bond yields can fall further on rate cut expectations and yields are expected to fall to below repo rate levels of 6.25%.

The fall in inflation, while positive for bond yields can be negative for the Sensex and Nifty. The sharp drop in prices of farm produce is leading to farmers protesting across the country and states writing off farm loans. Drop in rural income coupled with strained state finances can lead to strain on the rural economy leading to rural consumption coming off.

Inflation risks that were playing in the minds of bond market participants are receding leading to bond yields coming off. The new benchmark 10 year bond, the 6.79% 2027 bond saw yields close down 12 bps week on week at levels of 6.52%. The old 10 year benchmark bond, the 6.97% 2026 bond, saw yields close down by 13 bps at 6.64% levels while the on the run bonds, the 6.79% 2029 bond and the 7.06% 2046 bond saw yields drop by 13 bps and 19 bps respectively to close at levels of 6.69% and 7.10%. The yield curve flattened and can flatten further as markets buy into spreads available in the longer bonds.

Two key inflation risks were being priced into bond yields, one was monsoons and the other was GST. Both the risks have receded with monsoons being forecast as normal and GST rates largely benign rather than inflationary. CPI inflation for May 2017 printed at a record low 2.18% against 2.99% seen in April. RBI has forecast that inflation will be benign in the first half of this fiscal year before starting to climb on the back of various factors that includes risks of monsoons and GST. RBI has also taken into account the inflationary impact of the rent allowance in the 7th Pay Commission and also upside risk to global crude oil prices. The rent allowance impact on inflation remains to be seen while crude oil prices have stabilized at around USD 50/bbl with forecasts down rather than up given the supply glut in the market.

One inflation factor that is still uncertain is the closing of the output gap. Increase in aggregate demand on economic expansions can lead to demand supply gap coming off, which can push up prices in the economy. Exports have grown by high double digit levels in March and April indicating that global demand is picking up.

CPI Inflation(Y-O-Y in %)

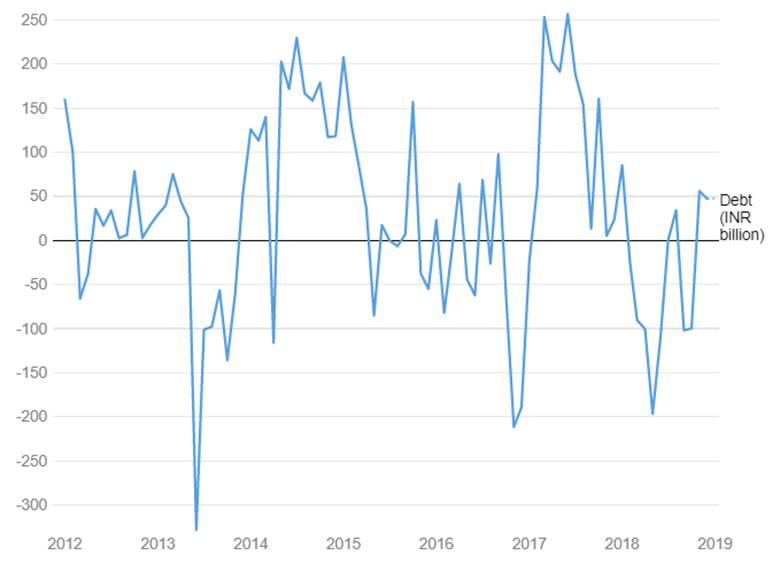

Monthly FII Net Investments

10 Year Government bond Yield India (%)