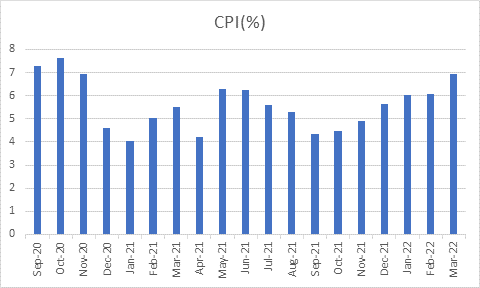

Passive fixed income investor who is investing in traditional products like bank deposits and debt mutual funds are earning returns way below than inflation growth rate. Losses occurring from these products are mounting and getting compounded every year. Compounding is an excellent tool for an investor if it is working in their favour, on the contrary it could pile-up� losses sharply. Latest domestic CPI print came in at 6.95% for the month of March 2022 and RBI raised inflation growth to 5.7%. Higher inflation expectation is resulting in rise in bond yields, causing drawdowns for G-sec investors.

Here are the few fixed-income investments and their performance against inflation (average of 6%)

Top Losers | Returns | Underperformance |

Liquid Funds | 3% | -3% |

Savings Account | 3% | -3% |

Fixed Deposits | 4% | -2% |

Tax Free Bonds | 4% | -2% |

Ultra-Short-term funds | 4.50% | -2% |

Short-term funds | 5% | -1% |

Top Gainers | Returns | Outperformance |

PGINvIT | 35% | 29% |

A Corporate bond | 9% | 3% |

AA Corporate bonds | 8% | 2% |

Bharat Bond ETF 2032 | 7.28% | 1.28% |

Bharat Bond ETF 2030 | 7.19% | 1.19% |

AAA Corporate bonds | 6.50% | 0.50% |

SDLs and G-sec also underperformed as the yields rose sharply on the back of higher borrowing and inflation expectations. Currently 10-year G-sec 2032 is trading at 7.19% and SDL 12-year cut-off was at 7.18%.

Following workings are comparisons between fixed deposits, short-term mutual fund returns over inflation rate:

Assuming Rs. 100 invested in all the 3 mentioned fixed-income instruments. Y0 being the base year and Y1, Y2, Y3 are following years for which investment vales are given as per rates mentioned.

Instrument | Y0 | Y1 | Y2 | Y3 |

Inflation Index | 6% | 106 | 112 | 119 |

FD Rates | 4% | 104 | 108 | 112 |

Mutual Fund Returns | 5% | 105 | 110 | 116 |

Returns against inflation | ||||

Instrument | Y0 | Y1 | Y2 | Y3 |

FD Rates | 0% | -1.89% | -3.74% | -5.55% |

Mutual Fund Returns | 0% | -0.94% | -1.88% | -2.80% |

Returns against inflation are for above invested instruments are upward sloping. As the years pass by the losses are adding up from previous year and resulting in huge underperformance.

Solution to beat inflation

Change the approach of investing in fixed-income products, choose active investing style over passive. Active investments like investing directly in corporate bonds would help your money to beat current inflation rates and rising interest rates.

Following table shows, if an investor is in Y1, Y2, Y3 what yield is required from current investment for them to cover the previous losses and beat the current year inflation rate.

Required Investment Yield | |||

Instrument | Y1 | Y2 | Y3 |

FD Rates | 6.10% | 8% | 10.20% |

Mutual Fund Returns | 6.10% | 7% | 8.30% |

INRBonds is a specialized bond and fixed income research and transacting platform in India. Our purpose is to help customers like you to invest in bonds to help you save better. Through our proprietary research, we have identified following bonds as they meet the dual goal of a healthy return with a low-risk profile. Our curated list of bonds listed on INRBonds QuickInvest platform would help investors to achieve yields above inflation growth rate and help them recover previous year losses. Following options are just for illustration purpose not recommendations:

For Y2 Investors

An investor who earned lower returns than inflation rate and looking to beat current inflation of 6% can look at TVS Credit Services (TVSCL). TVS Credit Services Ltd is a full subsidiary of TVS motors, one of the most trusted and respected groups in India. The bond is offering a yield of 8.4%, yearly coupon of 10.9% and will mature in August 2024. TVS Credit is a lender giving loans to the road transport sector and INRBonds rated it with moderate risk.

Click here to read our credit report on TVS Credit Services ltd.

For Y3 Investors

An investor who witnessed drawdowns in their passive fixed income investments for last 2 years due to higher inflation, the current required rate of return (yield) to make up for previous loss and beat current year inflation is above 10%. Svatantra Microfinance 2027 bond is offering a yield of 11%, annual coupon of 11.77% and has 5 years to maturity. Svatantra Microfinance, promoted by the well-respected Kumar Mangalam Birla Family, is in the business of giving loans to women from largely unbanked segments. INRBonds proprietary risk score is moderate and factors all the credit positives & negatives for this issue.

Click here to read our credit report on Svatantra Microfinance Pvt Ltd